Shares of Papa John’s International (PZZA) plunged over 15% on Tuesday afternoon after reports emerged that asset manager Apollo (APO) has pulled back on its deal to acquire the long-standing pizza chain.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Reuters, the private equity firm rescinded its early October proposal to take the Kentucky-based company private in a $64-per-share deal. This happened about a week ago, insider sources told the outlet. Earlier, Apollo had sought to make the buyout move in conjunction with Irth Capital Management.

Apollo Pulls Acquisition Offer ahead of Papa John’s Q3

The decision comes as the asset manager intends to monitor Papa John’s performance in its latest earnings results. The pizza franchise’s Q3 2025 results are expected to be released on Thursday before the market opens. Wall Street anticipates a profit squeeze in the quarter, as data suggests potential softness in consumer spending.

Papa John’s was founded in 1984 and controls about 6,000 restaurants located across the world, including in China, where it recently shut down 41 underperforming restaurants.

During the third quarter, analysts expect Papa John’s to earn 41 cents per share, a 5% drop from 43 cents a year ago. However, the pizza restaurant chain’s revenue is expected to rise by 3% to $523.05 million, up from $506.81 million from the same period last year.

Papa John’s Fights to Keep Customers

In its previous quarter, Papa John’s recorded a modest sales growth, with global sales rising 4% to $529 million. This was driven primarily by higher revenue from its commissaries — centralized facilities where ingredients, dough, and other supplies are prepared and distributed to individual Papa John’s restaurants.

In North America, sales from its restaurants opened for at least a year rose by 1%. This is even as the pizza chain operator’s profits plunged 23% to $10 million, down from $13 million in the prior year. This slide comes from the company’s increased spending on marketing campaigns and customer loyalty programs.

Is PZZA Stock a Good Buy?

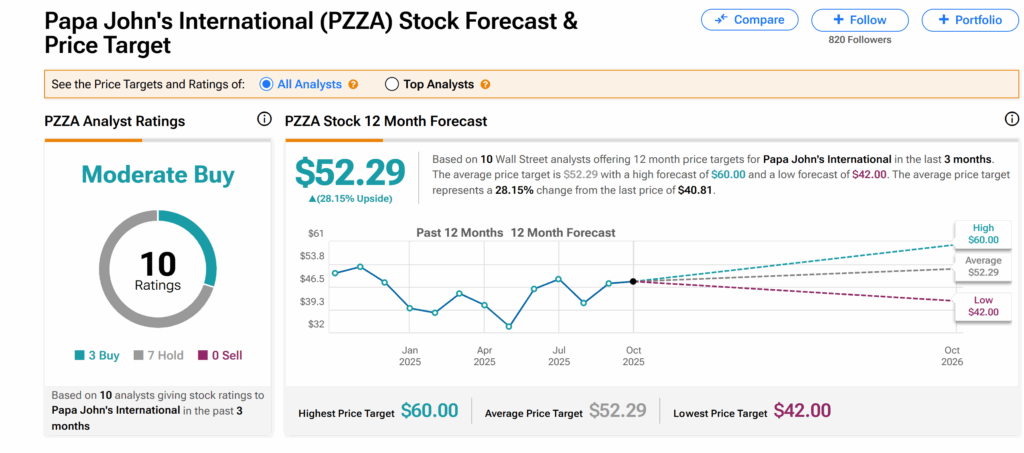

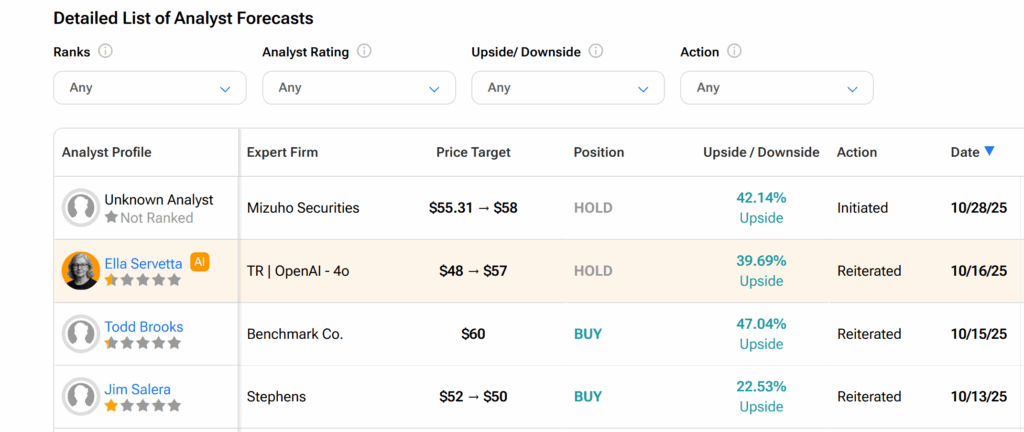

On Wall Street, Papa John’s shares currently have a Moderate Buy consensus rating based on three Buys and seven Holds issued by 10 analysts over the past three months. However, the average PZZA price target of $52.29 indicates a 28% upswing.