Getting support from an analyst tends to help stock prices for most companies unless something else is seriously going wrong in a different part of the company. For cybersecurity stock Palo Alto Networks (NASDAQ:PANW), a little love from an analyst started out giving it a slight tick up, but by Friday afternoon, the gains mostly boiled off, leaving Palo Alto hovering between positive and negative.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wedbush’s Dan Ives noted that Palo Alto Networks was set for its “…next stage of growth,” thanks to information derived from a set of channel checks on its cloud operations. What Ives found proved encouraging, as Palo Alto offered a strong cloud-based cybersecurity presence at a time when increasing numbers of companies were moving to cloud-based cybersecurity to address their needs. In fact, Ives pointed to “…large deal activity in the federal vertical” to serve as a “shining star” for Palo Alto.

That’s not all, either. Just a couple weeks ago, Palo Alto joined the S&P 500, a move that lit a fire under shares back then. Palo Alto took the slot formerly held by Dish Network (NASDAQ:DISH) during the S&P’s rebalancing, which comes every quarter. With a 52-week high only recently in the rear-view mirror, and Palo Alto shares outperforming the S&P 500 by a factor of better than four to one—Palo Alto is up 55% this year while the S&P 500 itself is up just 11.5%—there’s a lot of reason to like Palo Alto.

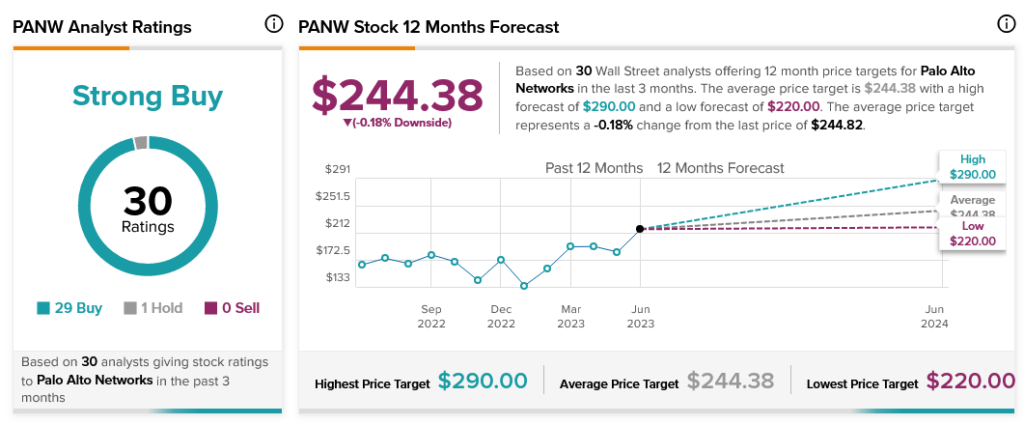

All of these factors together combine to make a solid buy. In fact, analyst consensus calls Palo Alto Networks a Strong Buy, supported by 29 Buy ratings and just one Hold. However, Palo Alto Networks stock’s average price target of $244.38 is virtually identical to its trading price today, leaving only a trivial upside potential or downside risk as the price moves today.