Palantir Technologies (PLTR) just proved why it remains one of the hottest names in artificial intelligence. The company reported second-quarter revenue of $1.0 billion, well ahead of the $940 million analysts expected. This marks a 48% jump year-over-year and a 14% gain from the previous quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Operating income surged 83% to $464 million, while free cash flow more than tripled to $569 million. By the end of the period, Palantir held $5.8 billion in net cash. After the report, PLTR shares jumped 4.6% in after-hours trading.

For the next quarter, management expects revenue of $1.1 billion and operating income near $495 million. For the full year, Palantir lifted guidance to $4.1–4.2 billion in revenue, up from $3.9 billion.

Senior equity analyst at Hargreaves Lansdown Matt Britzman summed it up by saying that Palantir’s staggering growth is showing no signs of slowing.

AI Platforms Drive Sticky Growth

Palantir builds software that helps governments and businesses analyze huge datasets and uncover hidden relationships. Its Gotham platform powers military and police operations, while Foundry serves healthcare, finance, and other industries.

A critical edge comes from Palantir’s “ontology framework,” which connects fragmented datasets and makes them usable in real time. More recently, its AI Platform integrates large language models directly into Gotham and Foundry, helping customers tap the generative AI wave.

As Britzman noted, once clients adopt Palantir’s system, it becomes extremely difficult to leave. The data insights are too valuable, which makes revenues sticky and recurring. Bootcamps modeled after Salesforce further embed Palantir into customer workflows, turning trials into long-term contracts.

Commercial Contracts Gain Importance

Government deals remain Palantir’s backbone, but analysts say investors should keep their eyes on commercial growth. This is where the true addressable market lies, with enterprises rushing to adopt AI-driven data solutions.

The United States has been Palantir’s fastest-growing market, with both government and commercial segments contributing to the latest surge. If the commercial side continues expanding at this pace, it could dwarf the government business over time.

Valuation Creates Investor Risks

Despite the knockout numbers, Palantir’s valuation is sky-high. The stock trades at nearly 240 times expected earnings, more than double its average since going public in 2020. This means the market is pricing in relentless growth.

Momentum is powerful when it works, but it is fickle. To justify today’s multiple, Palantir must keep crushing expectations quarter after quarter. Any stumble could spark a painful correction.

Britzman’s caution is clear that profits need to consistently and significantly outperform to sustain this valuation. This is not impossible, but it is far from guaranteed.

There Are Governance and ESG Risks

Palantir carries some ESG risks that investors should not ignore. The company’s three co-founders maintain tight control through a complex share structure, limiting shareholder influence. The board does not directly oversee environmental strategy, and the company has not tied executive pay to ESG metrics.

While Sustainalytics rates Palantir’s management of ESG issues as average, risks remain around data privacy, governance, and shareholder rights.

Key Takeaway

Palantir is firing on all cylinders, delivering billion-dollar quarters and raising guidance with no signs of slowing. Its software is deeply embedded in both government and commercial operations, giving it sticky, recurring revenue.

Yet valuation is stretched to extremes. Investors buying at these levels are betting that Palantir not only sustains but accelerates its momentum in the years ahead. If it does, the stock could keep climbing. If not, the comedown could be brutal.

Is Palantir a Buy, Hold, or Sell?

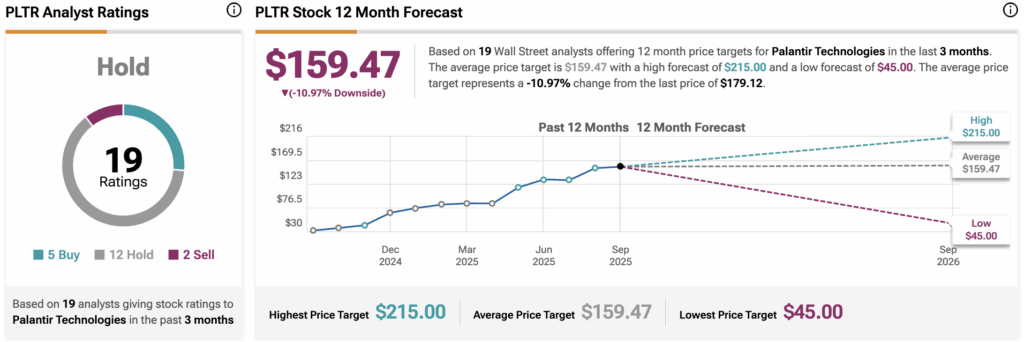

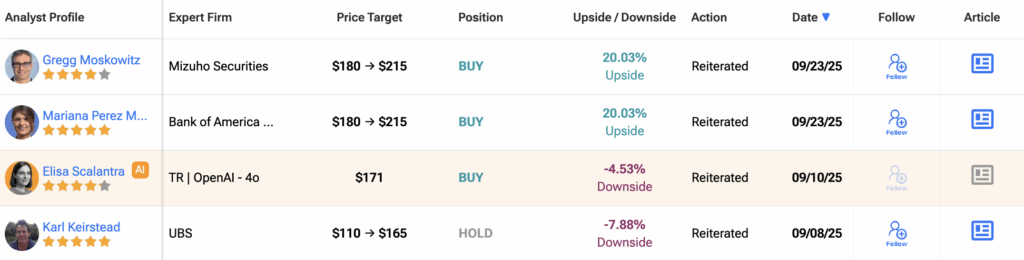

Palantir holds a Hold consensus rating based on 19 Wall Street analysts over the past three months. Out of these, five analysts recommend a Buy, 12 suggest a Hold, and two advise a Sell.

The average 12-month PLTR price target is $159.47, which implies a downside of nearly 11% from the last close.