It’s not uncommon for hype to carry a stock beyond its fair valuation, particularly in times of market exuberance. For the past year plus, one trend has had the hype gods pushing it along – AI, of course. Since the rise of ChatGPT, stocks with a strong AI theme have often been the market’s biggest winners and one name that’s made the most of that opportunity is Palantir (NYSE:PLTR).

Shares of the big data specialist have soared by 172% over the past 12 months, most of which have been accrued in the wake of the company launching its Artificial Intelligence Platform (AIP). Palantir has been bringing attention to its growing adoption, noting that the product is seeing strong demand – that is good news for the prospects of its commercial segment. Often seen as its weak point and not capable of matching its bread-and-butter government business, the tables turned in the Q4 print, with Palantir’s commercial segment showing healthy growth in contrast to stagnating government work.

5-star investor Richard Durant notes the momentum seen in Palantir’s growth profile and highlights the overall health of the business.

“Palantir’s growth has improved in recent quarters and should increase further in 2024, particularly if the company’s government business strengthens,” Durant noted. “Palantir is also both profitable and generating free cash flow, with the company’s margins continuing to steadily improve. These factors, along with a strong narrative, have contributed to Palantir’s premium valuation.”

That “premium valuation” is the catch, however, with the hype factor entering the conversation. On the back of AIP strength, Durant has expected growth will likely “continue accelerating.” The problem is that it also likely won’t be enough to “meet rapidly inflating expectations.”

“While growth has picked up, Palantir has also continued to benefit from multiple expansion, which is not that surprising given current hype around AI,” Durant further notes.

And now, while Palantir’s fundamentals seem robust enough, given a “fairly extreme” valuation, the risk around an investment has increased and potential near-term gains appear somewhat limited. For now, according to Durant, investors might keep on piling in to anything connected to AI, but valuation “will count eventually.”

To this end, Durant rates PLTR shares as a Hold (i.e., Neutral). (To watch Durant’s track record, click here)

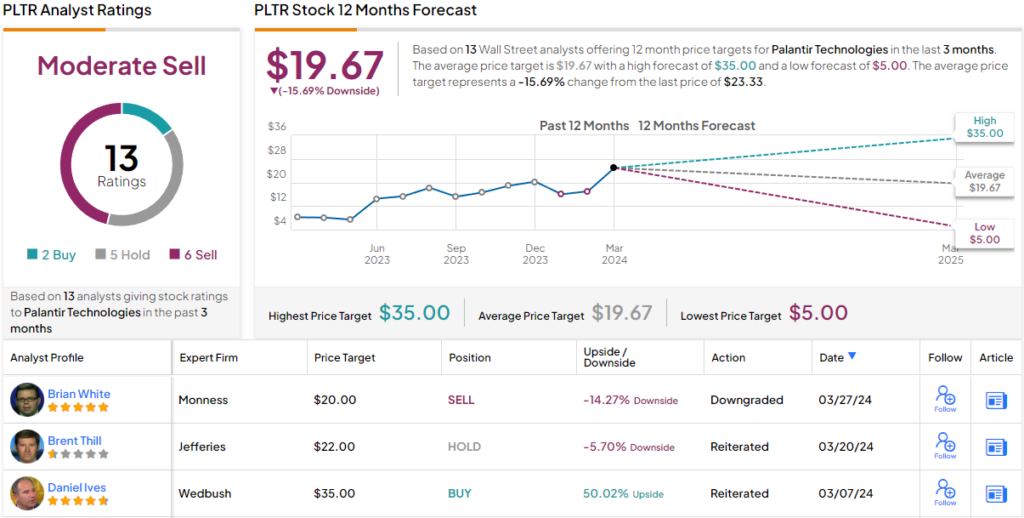

Durant remains on the sidelines, but as a whole, Wall Street’s analyst community takes a more bearish stance. Based on a mix of 6 Sells, 5 Holds, and 2 Buys, the stock claims a Moderate Sell consensus rating. Going by the $19.67 average price target, a year from now, shares will be changing hands for ~16% discount. (See Palantir stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.