Like several other industries, AI (artificial intelligence) is also reshaping defense and national security, and two stocks that are grabbing investor attention are Palantir Technologies (PLTR) and BigBear.ai (BBAI). With both companies operating in high-stakes markets, investors are wondering which AI defense stock is a better bet in the long term. Let’s break it down.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Is BigBear.ai Similar to Palantir?

Yes, BigBear.ai and Palantir are similar in that both provide AI-driven solutions for the government and defense sectors, but they differ in size and strategy. However, Palantir has built a global reputation with its enterprise AI platform serving both government and commercial clients. Meanwhile, BigBear.ai is emerging as a defense-focused player specializing in biometrics, supply chain security, and autonomous systems.

Both stocks have delivered strong returns for investors. BBAI stock has surged over 110% in 2024 and has continued its momentum in 2025 with a year-to-date gain of 64%. PLTR stock rose nearly 400% in 2024 and is up about 147% year-to-date in 2025.

BBAI’s Challenges

Despite its stock gains, BigBear.ai faces challenges. The company’s Q2 2025 revenue fell 18% to $32.5 million, and the adjusted loss widened to $0.71 per share from $0.06 per share a year ago. Looking ahead, management withdrew its EBITDA guidance. In addition, it now expects 2025 revenue of $125–$140 million, down from $160 million to $180 million, highlighting near-term risks.

On the plus side, BigBear.ai now has its strongest balance sheet ever, holding $391 million in cash and a net positive cash position for the first time. This gives the company the flexibility to invest in growth and explore M&A opportunities.

Palantir’s Financial Success

Unlike BigBear.ai, Palantir’s latest financial performance has impressed investors. The company exceeded $1 billion in revenue in Q2 2025 for the first time, with adjusted operating margins rising to 46%. It also raised its full-year 2025 revenue forecast to $4.142–$4.150 billion, up from the previous estimate of $3.89–$3.90 billion.

However, the high P/E ratio signals potential overvaluation. PLTR’s P/E ratio is around 600, far above the sector average of 31. Despite this rich valuation, Palantir benefits from its long track record, strong government contracts, and growing commercial adoption, making it less volatile than smaller players like BigBear.ai.

BBAI or PLTR: Which Stock Offers Higher Upside, According to Analysts?

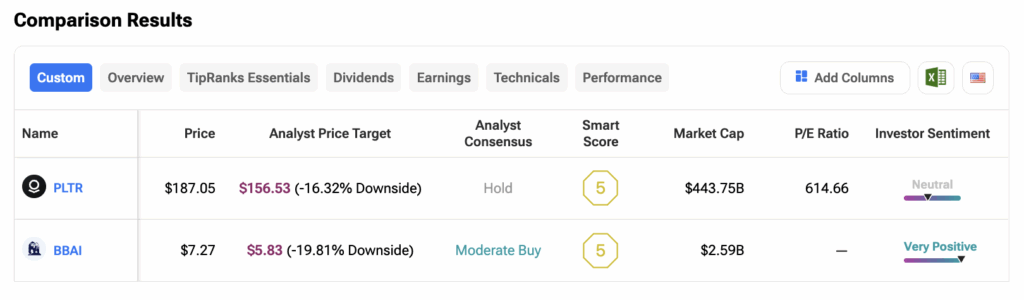

Using TipRanks’ Stock Comparison Tool, we compared BBAI and PLTR to see which AI stock analysts favor. BBAI carries a Moderate Buy rating from analysts, while PLTR has a Hold rating. Both stocks have surged recently, and analysts see limited upside in the near term. BigBear.ai’s average stock price target of $5.83 suggests about 20% downside. Palantir has a price target of $156.53, implying a 16.3% downside.

Conclusion

BigBear.ai is much smaller and still unprofitable, with its growth hinging on securing new federal contracts, adding volatility. But, as AI adoption grows in defense and civilian sectors, BigBear.ai has space to work with Palantir rather than compete against it. Moreover, BBAI stock’s recent surge shows investor optimism, though reliance on a handful of large deals means turbulence is likely to continue.

Palantir, on the other hand, has already cemented its position as a leading AI player with strong government and enterprise contracts, offering investors greater stability and lower execution risk.