AI software company Palantir Technologies (PLTR) is suing two of its former top engineers after claiming that they stole confidential information to start a competing firm. In a lawsuit filed on Thursday in Manhattan federal court, Palantir said that Radha Jain and Joanna Cohen—who both played key roles in developing the company’s AI software—used their insider knowledge to help launch Percepta AI, which offers a product similar to Palantir’s.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to the lawsuit, Jain and Cohen had access to Palantir’s “crown jewels,” including source code and sensitive customer data. Palantir claims that this information was misused to create a copycat platform that also helps businesses and governments make smarter decisions using their own data. Palantir claims that Jain and Cohen breached signed agreements that prohibited them from competing with Palantir for a year, soliciting its clients or employees for two years, and using its confidential material outside the company.

Notably, Jain left the company in November 2024, while Cohen resigned in February 2025. In addition, Percepta AI is already staffed with at least 10 former Palantir employees, including co-founder and CEO Hirsh Jain, who is Radha Jain’s brother. As a result, Palantir is asking the court to enforce these agreements.

Is PLTR Stock a Good Buy?

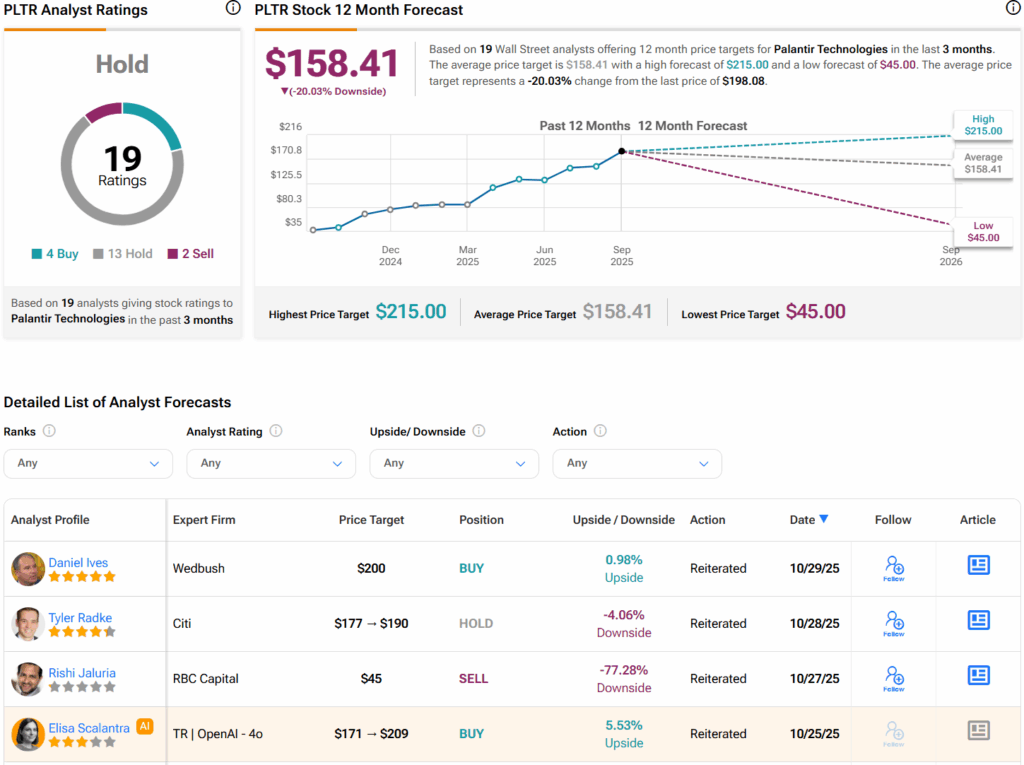

Turning to Wall Street, analysts have a Hold consensus rating on PLTR stock based on four Buys, 13 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average PLTR price target of $158.41 per share implies 20% downside risk.