Palantir (NASDAQ:PLTR) stock only gets a modest amount of bullish support on Wall Street, but that hasn’t impacted its ascent in any way. After all, the big data AI company has been one of the AI-driven bull market’s biggest winners. The proof is in the incredible 2,381% gains notched over the past three years.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That said, while many analysts take a skeptical stance here, one, in particular, has regularly banged the drum for PLTR. That is Wedbush analyst Daniel Ives, who has remained unequivocal in his support.

In fact, with Palantir reporting Q3 earnings today after the close, claiming the results and guide will be “another major step in the right direction as Karp & Co. build out this AI juggernaut,” the 5-star analyst has just raised his price target from $200 to a new Street-high of $230, suggesting the stock will gain another 15% from hereon in. Hardly needs mentioning, Ives’ rating stays an Outperform (i.e., Buy). (To watch Ives’ track record, click here)

As AIP remains central to delivering value for customers, Ives thinks the $1.09 billion revenue consensus estimate is “very beatable,” with the Street still underappreciating Palantir’s commercial momentum. The analyst’s recent field checks indicate exceptionally strong demand for AIP across both commercial and government sectors, driven by its ability to solve large-scale operational challenges, resulting in new customer wins and expansion of existing contracts.

Meanwhile, Palantir’s growing ecosystem of partnerships further strengthens its position. The company recently announced a collaboration with Snowflake to integrate Snowflake’s AI Data Cloud with Palantir Foundry and AIP, enabling customers across industries to build faster, more secure, and more efficient AI-driven data pipelines. Additionally, Nvidia unveiled a “strategic potentially game changing” partnership with Palantir to develop an integrated operational AI tech stack that combines Nvidia’s Blackwell architecture with AIP to improve enterprise and government systems.

As Palantir’s platform solutions become increasingly embedded across the enterprise landscape, with U.S. commercial revenue projected to grow more than 85% in FY25, Ives thinks these initiatives place Palantir in a “strong spot to drive continued growth from AI demand.”

At the same time, the increased AI investments under the Trump Administration, including initiatives such as Project Stargate, are expected to benefit Palantir’s government business as Washington moves deeper into the “strategic AI infrastructure build-out stage.”

Yet, the main reason behind Wall Street’s generally lukewarm attitude toward Palantir is based on what many market watchers consider to be an untenable valuation. The growth might be impressive, but it does not merit such a lofty multiple, goes the line of thinking. But that should not deter anyone from getting on board, says Ives.

“While investors will continue to fret about valuation we believe this will ultimately be a trillion dollar market cap over the next 2-3 years as Palantir builds out its commercial business into a multi-billion dollar machine monetizing the use cases in the AI Revolution,” the analyst summed up.

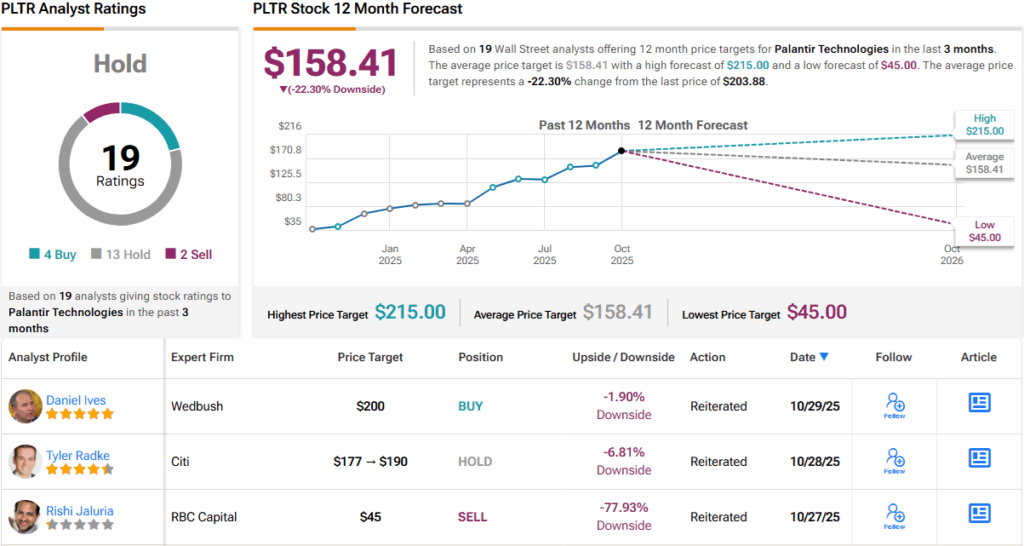

3 other analysts are also positive on PLTR’s prospects, but with an additional 13 Holds and 2 Sells, the analyst consensus rates the stock a Hold (i.e., Neutral). Going by the $158.41 average target, a year from now, shares will be changing hands for a 22% discount. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.