Palantir Technologies (PLTR) is set to report its third-quarter earnings on November 3, and the options market is expecting a volatile reaction. Based on options pricing, traders are expecting an 10.48% move in either direction after results, which is lower than Palantir’s average post-earnings move (in absolute terms) of 16.8% over the past four quarters.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The 10.48% move suggests that investors are bracing for sharp swings as they look for updates on AI contracts, government deals, and commercial growth in the upcoming report.

What Is Wall Street Expecting from PLTR’ Q3 Earnings?

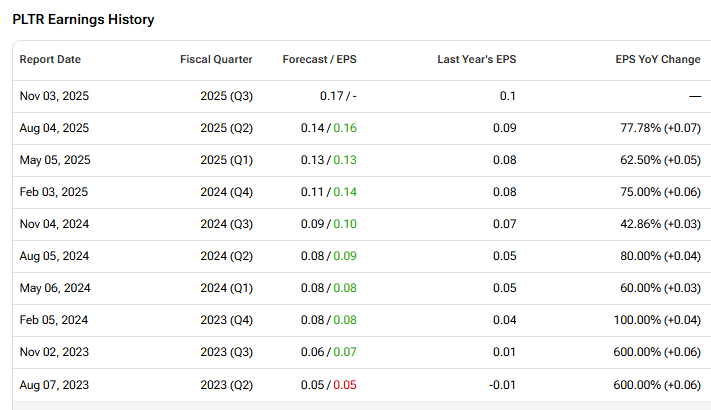

Analysts expect the company to report strong top- and bottom-line numbers, driven by rising demand for the company’s AI Platform (AIP). Wall Street expects PLTR to report earnings of $0.17 per share, up 70% from last year.

Also, revenues are expected to increase nearly 50% year-over-year to $1.09 billion. Notably, AMD has an encouraging earnings surprise history. The company missed earnings estimates just once out of the previous nine quarters.

Top Analyst’s Take Ahead of Q3

In a new report today, Wedbush analyst Dan Ives reiterated his Buy rating on Palantir and lifted the price target to a new Street-high of $230 (up from $200), implying 14.7% upside potential. The five-star analyst said today’s earnings could be a major moment for CEO Alex Karp and his team, marking another step forward in Palantir’s push to expand its AI business.

While some worry about valuation, he sees Palantir heading toward a $1 trillion market cap in the next few years as it grows its commercial business into a multi-billion-dollar AI player.

Is PLTR a Good Stock to Buy Now?

Overall, Wall Street is sidelined on PLTR stock, with a Hold consensus rating based on four Buys, 13 Holds, and two Sell recommendations. The average PLTR stock price target of $158.41 implies 20.98% downside risk from current levels.