Palantir Technologies (PLTR) is set to report its third-quarter earnings on November 3, and the options market is expecting a volatile reaction. Based on options pricing, traders are expecting an 11.67% move in either direction after results, which is in line with Palantir’s average post-earnings move of 10.8% over the past four quarters.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The implied move suggests that investors are bracing for sharp swings as they look for updates on AI contracts, government deals, and commercial growth in the upcoming report.

What to Expect on November 3

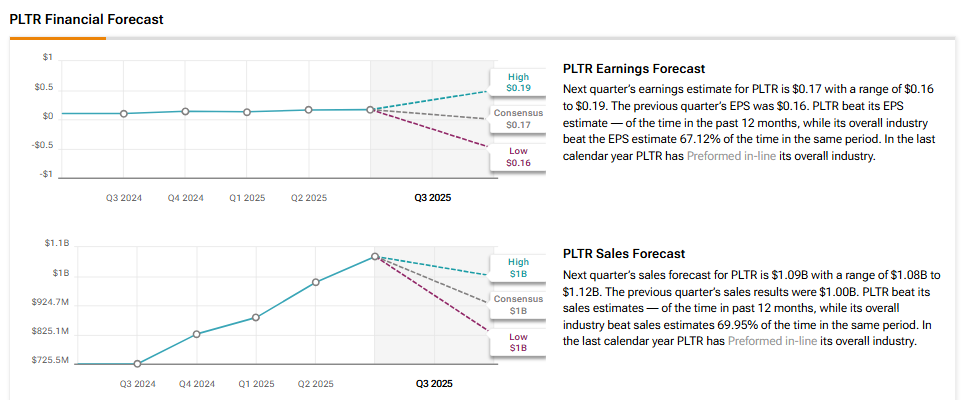

Analysts expect the company to report strong top- and bottom-line numbers, driven by rising demand for the company’s AI Platform (AIP). Wall Street expects PLTR to report earnings of $0.17 per share, up 70% from last year. Also, revenues are expected to increase nearly 50% year-over-year to $1.09 billion.

Analyst’s Take Ahead of Q3

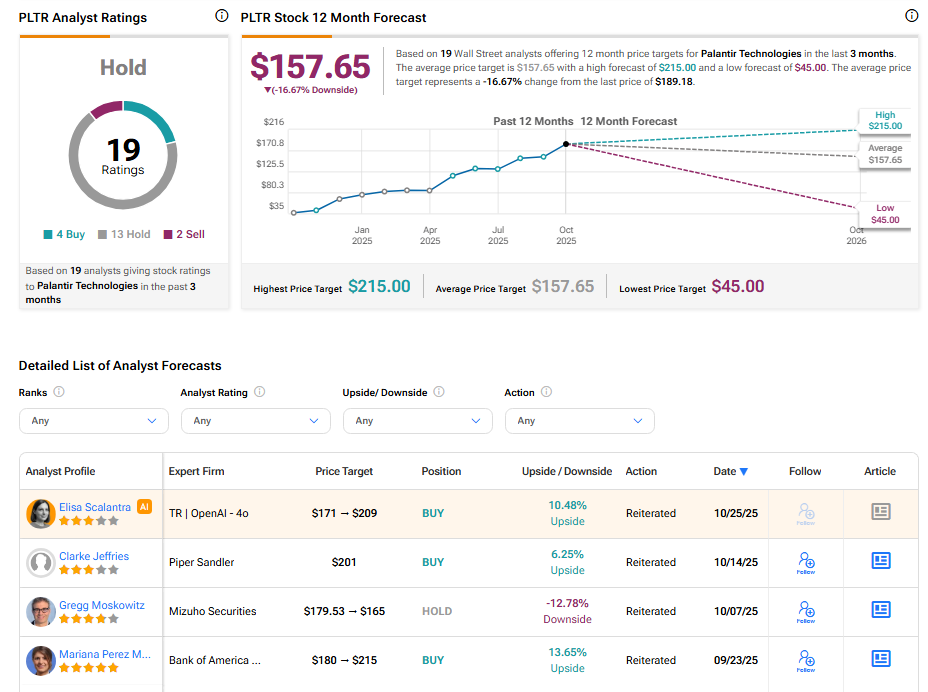

Ahead of the Q3 print, Piper Sandler analyst Clarke Jeffries reiterated a Buy rating and raised his price target from $182 to $201, reflecting continued upside potential in the AI stock. Jeffries acknowledged that Palantir’s valuation remains high, leaving little margin for error if growth slows. However, he believes the company has not yet reached its “peak growth” phase and sees no clear “catalyst to halt current momentum.”

Jeffries cited several reasons for his bullish view. He pointed to Palantir’s solid revenue base, with over $7 billion in signed contracts and another $4 billion in IDIQ (Indefinite Delivery, Indefinite Quantity) deals. He also noted triple-digit growth in Commercial bookings this year.

Is PLTR a Good Stock to Buy Now?

Overall, Wall Street is sidelined on PLTR stock, with a Hold consensus rating based on four Buys, 13 Holds, and two Sell recommendations. The average PLTR stock price target of $157.65 implies 16.67% downside risk from current levels.