While some analysts hail Palantir (NASDAQ:PLTR) and the mighty AI fortress it’s built, others aren’t quite so convinced that AI is its true saving grace. That concern weighed on investors today, as some took the money and ran, sending Palantir stock down slightly in Thursday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The word out of Monness, Crespi, Hardt—by way of analyst Brian White—is that Palantir may be just a bit too focused on AI for its own good, and might ultimately suffer for it. White noted that Palantir has been “overpowered” by artificial intelligence propaganda, in what might be an attempt to avoid “troubling” trends in cloud-based operations. Ultimately, White said in a note to investors, Palantir’s “newfound mantra” of AI has provided “…an enticing investment thesis to pacify the market during these challenging times.”

Given the sheer range of opinion seen on other analyst fronts, that’s not surprising. Some believe Palantir is on track to beat earnings when they come out early next week. Others believe that the maxim about being fearful when others are greedy—and vice versa—still applies here, and in a bigger way than normal in light of Palantir’s impressive share price appreciation of late. Certainly, anything having to do with generative AI has something of a market going forward. Just about any software platform out there can derive some benefit from having an AI attachment. But it’s also easy to believe that AI is a new gold rush in the making, especially from stocks that only got started in the field.

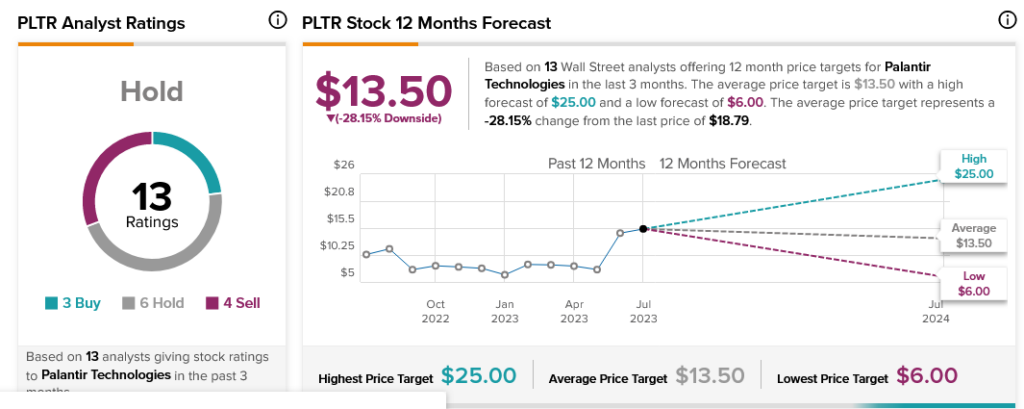

So, the word from the analyst community takes on a new importance, and it’s little help. Currently, Palantir stock is rated Hold, thanks to three Buy ratings, four Sell, and six Hold. With the split that close to even, it’s little help for a concerned investor. Worse, Palantir stock comes with a 28.15% downside risk on its $13.50 average price target.