Shares of PagerDuty(NYSE:PD) gained more than 6% on Thursday’s extended trade after the company beat third-quarter results by a wide margin. The impressive performance was driven by an increased appetite for automation and a strong demand for generative AI.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

PagerDuty is a digital operations management platform that helps businesses monitor and respond to critical incidents in real-time.

Results in Detail

PagerDuty reported earnings of $0.20 per share in the third quarter, which handily surpassed the analysts’ expectations of a loss of $0.14. Further, the reported figure compares favorably with earnings of $0.04 per share in the prior year’s quarter. Similarly, total revenues climbed 15.4% year-over-year to $108.7 million and exceeded the consensus estimate of $107.7 million.

In other key metrics, the company registered an 18% year-over-year jump in total free and paid customers to over 27,000. Concurrently, the dollar-based net retention rate was 110% as of October 31, 2023, compared to 123% in the year-ago period.

Looking forward, management expects revenue for the fourth quarter to be in the range of $109.5 million to $111.5 million, representing a growth rate of 8% to 10% year-over-year. Analysts were expecting $110.9 million in revenue. Meanwhile, adjusted EPS is anticipated to be between $0.14 and $0.15.

As for Fiscal 2024, management expects revenue to rise nearly 16% year-over-year, while earnings are expected to be between $0.72 and $0.73 per share.

Is PD a Good Stock to Buy?

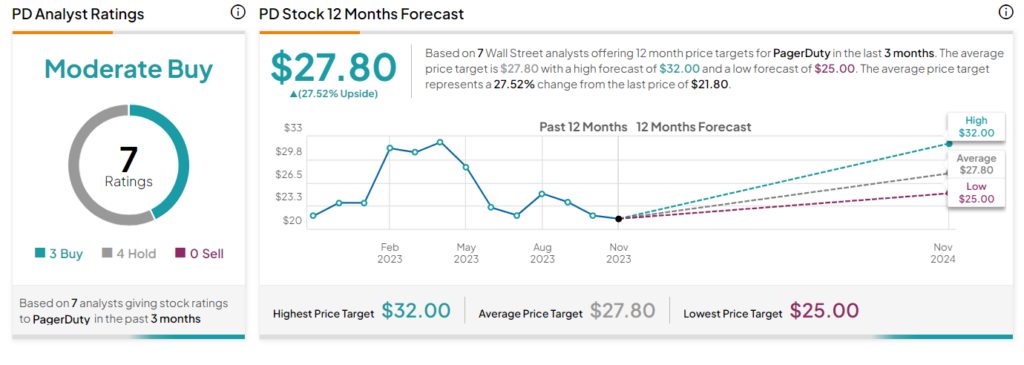

Following the earnings release, Craig-Hallum analyst Chad Bennett reiterated a Hold rating on the stock with a price target of $25.

PagerDuty stock has a Moderate Buy consensus rating based on three Buys and four Holds. The average PD stock price target of $27.80 implies 27.5% upside potential. The stock has declined 15.7% year-to-date.