Pagaya Technologies (NASDAQ:PGY) rallied in pre-market trading after top-rated Jefferies analyst John Hecht initiated coverage on the stock with a Buy rating and a $2.50 price target. The analyst’s price target implies an upside potential of 79.8% at current levels for the tech company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Hecht pointed out that Pagaya excels in the business-to-business-to-consumer space (B2B2C). The analyst added that the company stands out as a major issuer of personal loan asset-backed securitization and is a top-10 subprime issuer when it comes to auto loans. The analyst cited Pagaya’s “unique” pre-funded asset-backed securities (ABS) model that lowered inventory and execution risks. Hecht has predicted ongoing success for the company due to a “powerful network effect” and product flywheel.

Moreover, recently, Pagaya also announced a partnership with Exeter Finance, an auto finance company, that will integrate Pagaya’s AI-driven auto product.

Is PGY Stock a Good Buy?

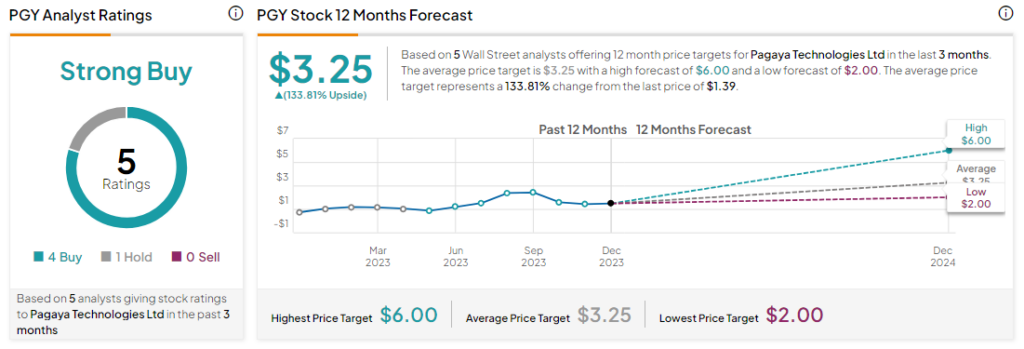

Analysts remain bullish about PGY stock with a Strong Buy consensus rating based on four Buys and one Hold. In the past year, PGY has skyrocketed by more than 100% and the average PGY price target of $3.25 implies an upside potential of more than 100% at current levels.