Shares of PacWest BanCorp (NASDAQ:PACW) plunged more than 52% in Wednesday’s extended trading session in reaction to a Bloomberg report that the California-based lender is evaluating strategic options, including a potential sale. PacWest later issued a statement to confirm that it is in talks with certain parties and updated investors on its financial position.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The news dragged down stocks of regional banks Western Alliance (WAL), Comerica (CMA), and Zions Bancorporation (ZION) by more than 22%, 7%, and 9%, respectively, in Wednesday’s after-hours trading.

The Bloomberg report stated that aside from a possible sale, PacWest is also contemplating a breakup or raising fresh capital. Sources revealed that the bank has not commenced a formal auction process yet.

There seems to be no respite for investors who continue to be concerned about the regional banking space even after JPMorgan Chase (NYSE:JPM) took over First Republic after the regional financial institution was seized by the Federal Deposit Insurance Corporation (FDIC). Regional banks have been battered by tightening monetary policy and their exposure to commercial real estate loans. These banks faced significant deposit outflows following the collapse of the Silicon Valley Bank and Signature Bank in March.

PacWest Issues Statement

PacWest confirmed in a statement that several potential partners and investors have approached it and discussions are ongoing. The bank said that as previously announced, it has explored strategic asset sales, including placing its $2.7 billion lender finance loan portfolio under held-for-sale in the first quarter.

The bank assured that it did not experience any “out-of-the-ordinary” deposit outflows following the sale of First Republic to JPMorgan and other related news. In fact, core customer deposits have increased since March 31, 2023, with total deposits coming in at $28 billion as of May 2, 2023.

Further, insured deposits accounted for 75% of overall deposits compared to 71% at the end of Q1 2023 and 73% as of April 24, 2023. PacWest also paid down $1 billion of borrowings with its excess liquidity. “Our cash and available liquidity remains solid and exceeded our uninsured deposits, representing 188% as of May 2, 2023,” the bank stated.

Peer Western Alliance also issued a statement reaffirming its “financial strength.” It said that deposits have increased $1.2 billion quarter-to-date compared to $47.6 billion as of the end of Q1 2023. The bank provided several other financial details and reiterated its $2 billion quarter-over-quarter deposit growth rate outlook.

It is interesting to note that following the takeover of First Republic, JPMorgan CEO Jamie Dimon hinted at troubles at a smaller bank. “There may be another smaller one, but this pretty much resolves them all,” said Dimon on Monday.

Is PacWest a Buy, Hold, or Sell?

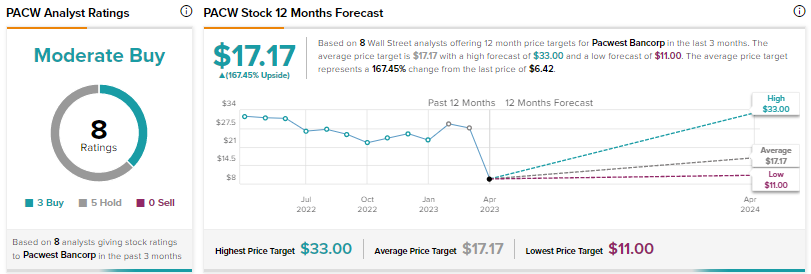

Wall Street’s Moderate Buy consensus rating for PacWest is based on three Buys and five Holds. The average price target stands at $17.17 compared to the closing stock price of $6.42 on May 3.