Just after the Great Depression, it became clear that people did not trust banks, at least for quite a while. Now, that distrust seems to be coming back, as PacWest Bancorp (NASDAQ:PACW) plunged nearly 10% at the time of writing. The biggest cause is a recent business update that shows a lot more people are turning away from PacWest and more toward, well, some other bank.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The business update PacWest offered up featured a disastrous statistic for any bank: deposits were down around 20% in the time between December 31, 2022, and March 20, 2023. That big drop in deposits left the bank’s cash flow crippled. Thus, it turned to potential new investors to raise capital. That didn’t turn out well either; conditions were far from ideal, as regional bank stocks weren’t doing well overall.

However, all was not lost. PacWest pulled cash in from several different sources, including the federal government. The Home Loan Bank kicked in a healthy $3.7 billion, and almost three times that amount came in from the discount window at the Federal Reserve. Finally, Apollo (NYSE:APO) kicked in an extra $1.5 billion through its Atlas SP Partners operation. Ultimately, PacWest may even have landed some new customers from Silicon Valley Bank; PacWest noted it had an extra 130 new accounts in its venture capital line since March 9.

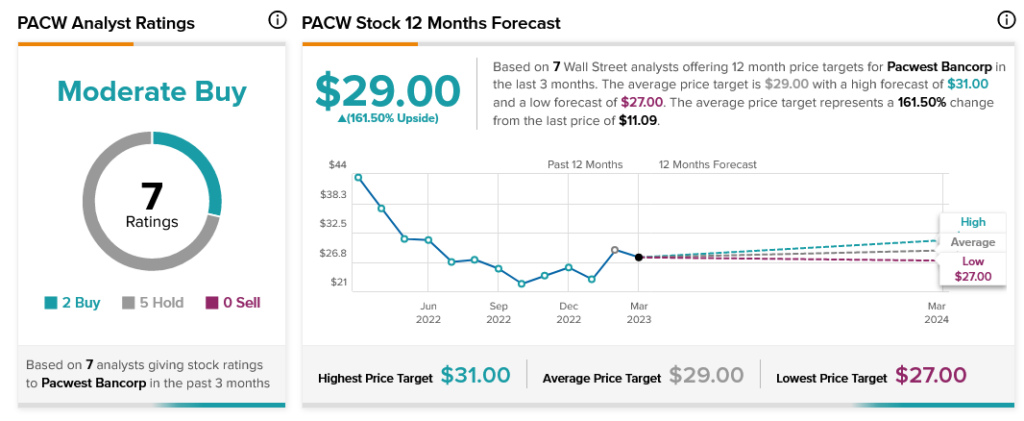

Despite the recent losses, analysts are still on PacWest’s side, as its stock is currently considered a Moderate Buy by analyst consensus with 161.50% upside potential thanks to its average price target of $29 per share.