SoundHound AI (NASDAQ:SOUN) shares are slightly red on a year-to-date basis, and fell 8% last Friday after news broke that the company’s CFO sold 60,000 shares. However, that snapshot doesn’t tell the full story. Indeed, zoom out just a bit further and the trailing twelve months reflect a whopping 252% gain.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Now, with shares trading some 40.0x 2026 Street revenue estimates of $214.0 million, H.C. Wainwright analyst Scott Buck says he is “beginning to get more push back from investors surrounding valuation.”

“However,” the analyst adds, “It’s important to recognize that 2026 Street revenue forecasts do not include any contribution from the recent acquisition of Interactions Corporation, which should contribute materially in 2026.”

Buck anticipates more information on revenue contributions from recent M&A activity when the company announces its Q3 results in early November, which could lead to an upward revision of 2026 revenue estimates.

The analyst also points out that current 2026 Street revenue expectations imply growth of only 28.9%, significantly lower than the nearly 50% growth seen in 2022 and 2023, an 84.6% increase in 2024, and the projected 96% growth in 2025.

“Keeping growth in line with recent years leads us to believe that 2026 revenue estimates are likely to move higher and drive 2027 Street revenue forecasts exceeding $300.0M,” Buck said on the matter.

Buck thinks revenue growth will come from cross-selling and upselling “new product capabilities” into recent acquisitions, including Interactions. Given the successful execution of this approach with Amelia, the analyst is confident the company can replicate this strategy with Interactions as well as with future acquisitions.

Moreover, the Street currently forecasts a 2026 adj. EBITDA loss of only $3.9 million, indicating that the path to profitability should become increasingly clear in the coming quarters.

“We believe this inflection point should be well received by investors, helping push SOUN shares higher,” Buck added.

Although it’s still early, the analyst points out that within a year investors will start looking toward 2027, which, as noted above, is when he anticipates the company could surpass $300 million in revenue and achieve positive adj. EBITDA. As a result, Buck summed up, he finds it “hard to imagine SOUN shares not trading higher in one year.”

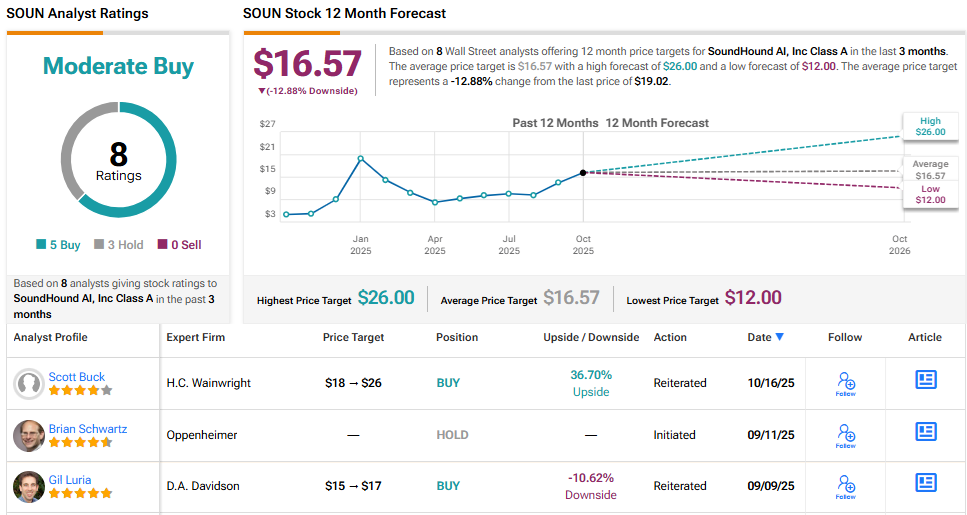

Accordingly, Buck maintained a Buy rating on the shares and raised his price target from $18 to a new Street-high of $26, suggesting the stock will gain ~37% over the coming months. (To watch Buck’s track record, click here)

4 other analysts are also bullish, and an additional 3 Holds combine to give SOUN a Moderate Buy consensus rating. However, the average target tells a different story; at $16.57, the figure implies a one-year decline of ~13%. It will be interesting to see whether other analysts boost their price targets or downgrade their ratings shortly. (See SOUN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.