Canadian cannabis producer OrganiGram Holdings (OGI) has announced a series of updates relating to the challenging conditions it is currently experiencing. Shares in OGI have now plunged 34% year-to-date.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company revealed that it is reducing its workforce by 220 employees, approximately 25% of its workforce, citing the global Covid-19 pandemic and the continuing evolution of the Canadian cannabis industry.

“These decisions are never easy to make, but we are committed to ensuring the Company is appropriately sized relative to market conditions” commented OrganiGram CEO Greg Engel.

With a reduced workforce, OGI believes it can continue to meet current and anticipated near term demand levels.

At the same time, the company will continue to cultivate less than the target production capacity of cannabis of its Moncton campus. Instead it will focus on bringing new cultivars to market and increasing the THC and terpene profile of its dried flower.

Looking forward, OGI will also postpone by one week the filing of its interim financial statements, interim management’s discussion and analysis and related certifications for the period ending May 31, 2020.

OrganiGram is relying on blanket exemptive relief granted by the Canadian securities regulatory authorities that permits it to delay the filing of its Q3 Interim Filings.

Given the timing of the company’s fiscal Q3 2020, Covid-19, and changing market dynamics, OGI now expects to report a decline in net revenue for fiscal Q3 2020 compared to fiscal Q2 2020 impacted by insignificant wholesale revenue being recorded in the quarter.

It also expects to report a decrease in selling, general & administrative (SG&A) expenses for fiscal Q3 2020 compared to fiscal Q2 2020, as well as negative adjustments to inventories and an asset impairment on its Moncton facility.

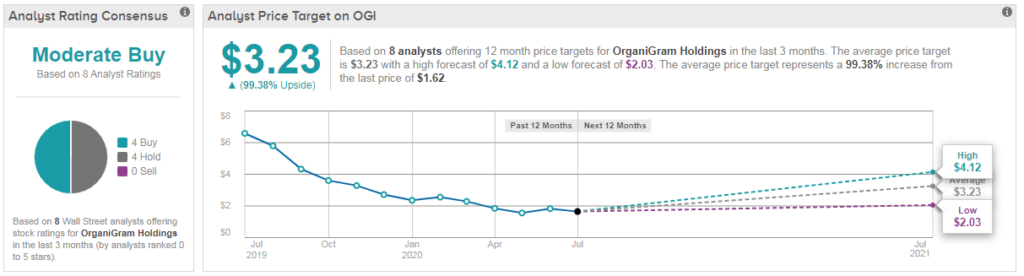

Overall, analysts are divided between hold and buy ratings on OGI stock, adding up to a cautiously optimistic Moderate Buy consensus. Meanwhile the $3.23 average analyst price target suggests the stock can almost double from current levels. (See OGI stock analysis on TipRanks)

Oppenheimer analyst Rupesh Parikh recently reiterated his hold rating on the stock. Although the analyst is upbeat on the longer-term potential at OGI, he remains sidelined due to ‘very difficult shorter-term industry conditions.’

However he gave a positive assessment of the longer-term picture: “The company continues to execute better than peers and, in our opinion, has a more manageable cost structure and clearer market strategy than many players” Parikh stated. Plus the analyst remains optimistic that efforts on the Cannabis 1.0 and 2.0 fronts coupled with industry rationalization could lead to stronger profitability from OGI going forward.

Related News:

UK Relaxes Rules On GWPH Cannabis Drug Epidyolex

Zynerba Plunges 48% On CBD Gel Miss; Needham Downgrades Stock To Hold

Gilead Sets Pricing for Covid-19 Treatment Remdesivir at $2,340 Per Patient