OraSure Technologies, Inc. (OSUR) announced that the Defense Logistics Agency has awarded the company a purchase order for its InteliSwab COVID-19 Rapid Test kits for over-the-counter (OTC) use as part of the National Pandemic Response. The order is estimated to be valued at $205 million and will be funded by the U.S. federal government. Shares were down 1% in pre-market trading at the time of writing.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

OraSure is a provider of point-of-care and home diagnostic testing and sample collection technologies. Per the terms of the deal, OraSure will provide its Rapid Test kits to over 25,000 sites across the United States from October 2021 to September 2022. (See OraSure Technologies stock charts on TipRanks)

In response to the news, President and CEO Stephen Tang, Ph.D., said, “We are exceptionally proud to work with the Defense Logistics Agency and the U.S. federal government to be part of the nation’s pandemic response. We strongly believe testing will play a critical role in controlling the recent outbreak of the Delta variant and help to prevent future outbreaks. We believe widespread testing will allow Americans to return to work and school safely, as well as save lives and livelihoods.”

The InteliSwab kit has a built-in swab and is a simple “swab, swirl, see” test which consumers can use easily by self-collecting a sample from the lower nostrils. The result is easy to read and is indicated within 30 minutes on the test stick itself, without using any instruments, batteries, smartphones, or laboratory analysis.

The InteliSwab Rapid Test kit has three Emergency Use Authorizations (EUA) from the Food and Drug Administration (FDA) for professional point-of-care use, prescription (Rx) home use, and OTC use.

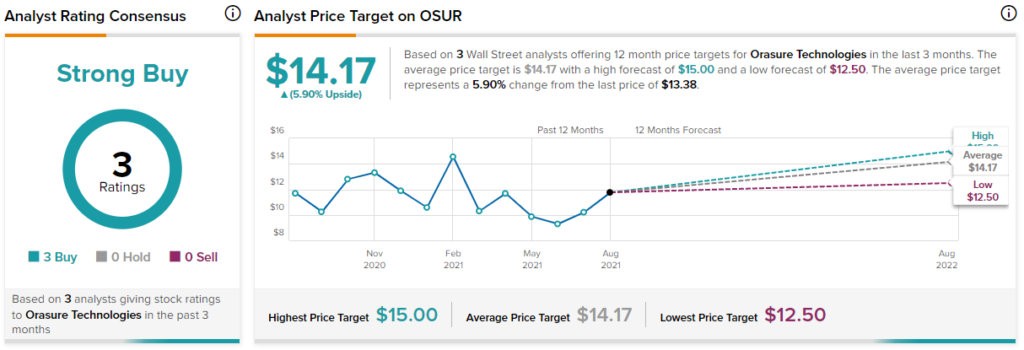

After OraSure reported its second-quarter results on August 3, Raymond James analyst Andrew Cooper lifted the price target on the stock to $12.50 (6.6% downside potential) from $11 while maintaining a Buy rating.

With 3 unanimous Buys, the stock commands a Strong Buy consensus rating. The average OraSure Technologies price target of $14.17 implies 5.9% upside potential to current levels. Shares have gained 5.8% over the past year.

Related News:

Ford Begins Pre-Production of F-150 Lightning as Demand Surges

GM Suspends EV Bolt Production to Mid-October – Report

Goldman Sachs Inks $2.24B Deal to Buy GreenSky