Shares of American enterprise software giant Oracle (ORCL) traded higher on Wednesday afternoon, despite an update that the company is one of several being questioned by Republican lawmakers in an investigation into tuition pricing practices by U.S. colleges. ORCL stock was up over 2% as of 2:29 p.m. EDT.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As a software company, Oracle provides its cloud infrastructure to companies across various industries, including in the education sector. Higher education institutions are among such enterprise customers served by the company.

Lawmakers Query ‘Algorithmic Collusion’

On Wednesday, the chairmen of the judiciary and antitrust committees of the two U.S. legislative chambers sent a letter to several organizations, requesting information on any tuition pricing algorithms they have developed for higher education institutions. They also inquired about how they use college applicants’ data on such technology. Oracle is one of these organizations, according to The New York Times.

Lawmakers raised concerns that American colleges might be engaging in “algorithmic collusion” by using enrollment management software (EMS) to increase profits and coordinate tuition fee pricing, financial aid, and admissions policies. This software might be using private algorithms to achieve this.

The letter noted that using a “common pricing formula or algorithm” or engaging in such practice through third-party companies violates the country’s antitrust laws.

“Companies selling EMS services to colleges and universities help schools extract more dollars from one last family each and every spring by taking part in what these companies call ‘financial aid leveraging,'” a letter addressed to David Coleman, CEO of non-profit organization The College Board, read in part.

Is Oracle a Buy, Hold, or Sell?

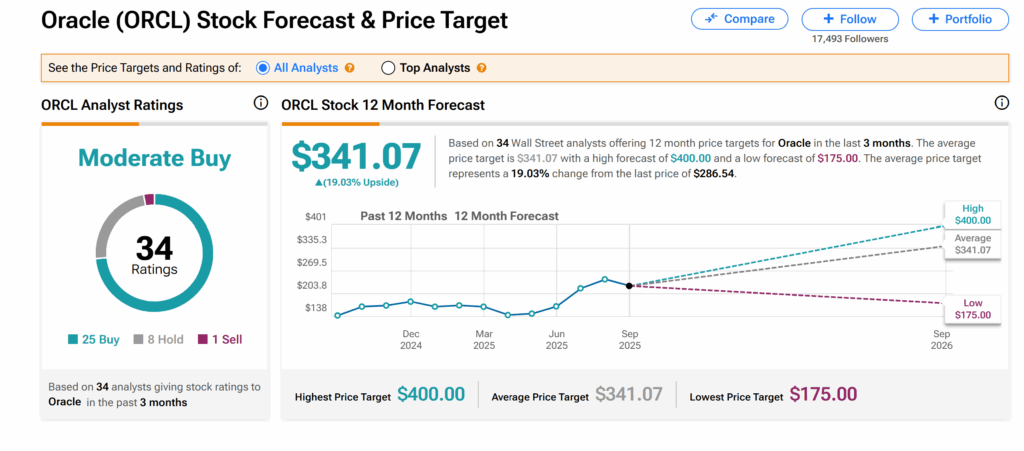

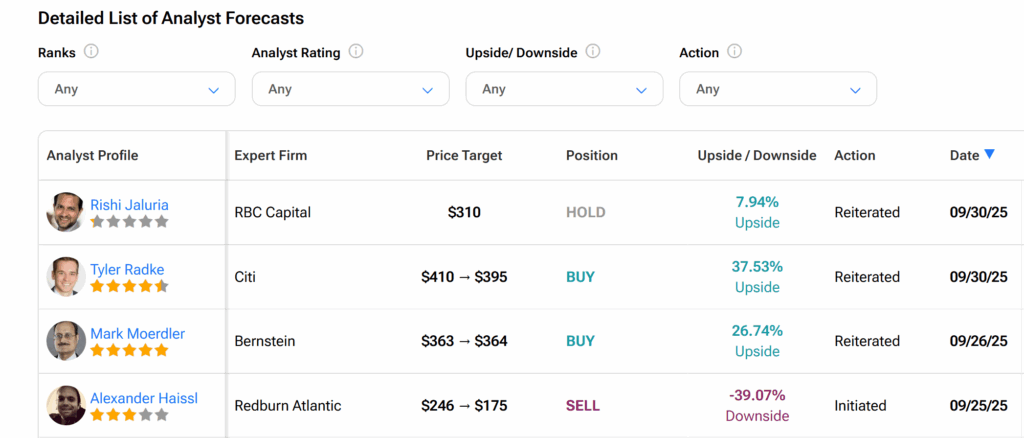

Turning to Wall Street, Oracle’s shares currently have a Moderate Buy rating based on 25 Buys, eight Holds, and one Sell assigned by 34 Wall Street analysts over the past three months, as seen on TipRanks. Furthermore, the average ORCL price target of $341.07 indicates an 18.87% upside potential from the current level.