Shares of Oracle (NASDAQ:ORCL) declined about 9% in after-hours trading yesterday after the company reported mixed results for the fiscal second quarter and provided weak Q3 revenue guidance. ORCL is a provider of cloud-based solutions for enterprises.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Q2 Earnings Snapshot

The company’s Q2 adjusted earnings per share increased over 11% year-over-year to $1.34, surpassing analysts’ estimates of $1.33. Meanwhile, revenue increased 5% to $12.9 billion but missed the analysts’ estimates of $13.05 billion. The increase was driven by the strength of the company’s Cloud Services segment, which jumped 25.2% year-over-year to $4.78 billion.

Looking ahead, ORCL expects revenue growth between 6% and 8% for the current quarter, including contributions from its Cerner acquisition, which was closed in late 2022. This compares with the analysts’ expectations of about 7.5% growth. Additionally, the company anticipates adjusted profit to range from $1.35 to $1.39 per share.

Analysts’ Mixed Reactions Post-Q2 Results

Following the release of fiscal Q2 earnings, ORCL stock received mixed reactions from Wall Street analysts, as three analysts rated it a Buy and four assigned a Hold rating. Jefferies analyst Brent Thill maintained a Buy rating on the stock. He believes that Oracle can successfully navigate through the current challenges and capitalize on its market opportunities.

Is Oracle a Buy or Sell?

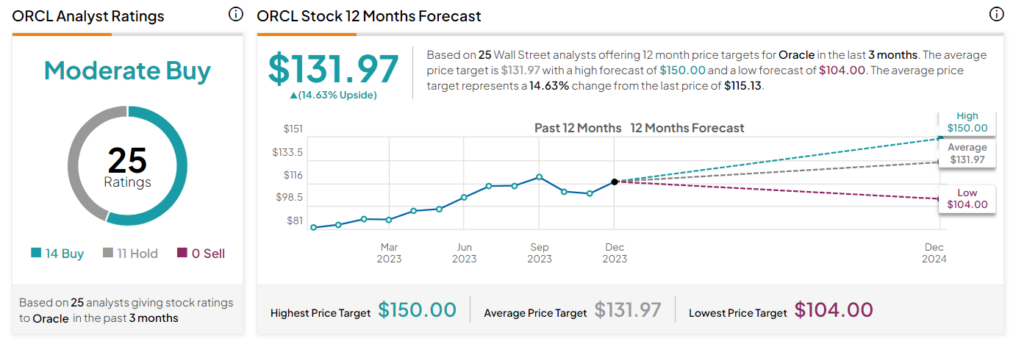

ORCL has received 14 Buys and 11 Hold recommendations for a Moderate Buy consensus rating. Further, the stock’s 12-month average price target of $131.97 implies 14.63% upside potential from current levels.