Oracle (ORCL) has announced a major leadership change, promoting two key executives to the role of co-CEO as the company pushes deeper into the AI and cloud infrastructure market. Clay Magouyrk, who led Oracle Cloud Infrastructure (OCI), and Mike Sicilia, president of Oracle Industries, will now serve as co-CEOs. Current CEO Safra Catz will transition to the role of executive vice chair on the board.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Following the news, ORCL stock gained about 4% in early Monday trading.

Also, Oracle is promoting two other executives. Mark Hura will become president of global field operations, and Doug Kehring will take on the role of principal financial officer.

These moves come as Oracle stock has surged, up 94% so far this year and 36% in the last month alone. The company’s recent success is largely due to its strong financials, involvement in the TikTok framework deal, and massive contracts with companies, including OpenAI, announced recently.

Magouyrk and Sicilia Lead Oracle’s Push Into AI

Magouyrk joined Oracle in 2014 after working at Amazon (AMZN). He helped build Oracle’s Gen2 cloud platform, which now supports large-scale data centers and AI training. His work has made OCI a key part of the company’s growth as demand for AI continues to rise.

At the same time, Sicilia helped update Oracle’s software for industries like healthcare, banking, utilities, and retail by adding AI tools and improving older systems to make them more user-friendly and efficient.

In a statement, Oracle’s Chairman and CTO, Larry Ellison, said, “A few years ago, Clay and Mike committed Oracle’s Infrastructure and Applications businesses to AI—it’s paying off. They are both proven leaders, and I am looking forward to spending the coming years working side-by-side with them.”

Is Oracle a Buy, Sell, or Hold?

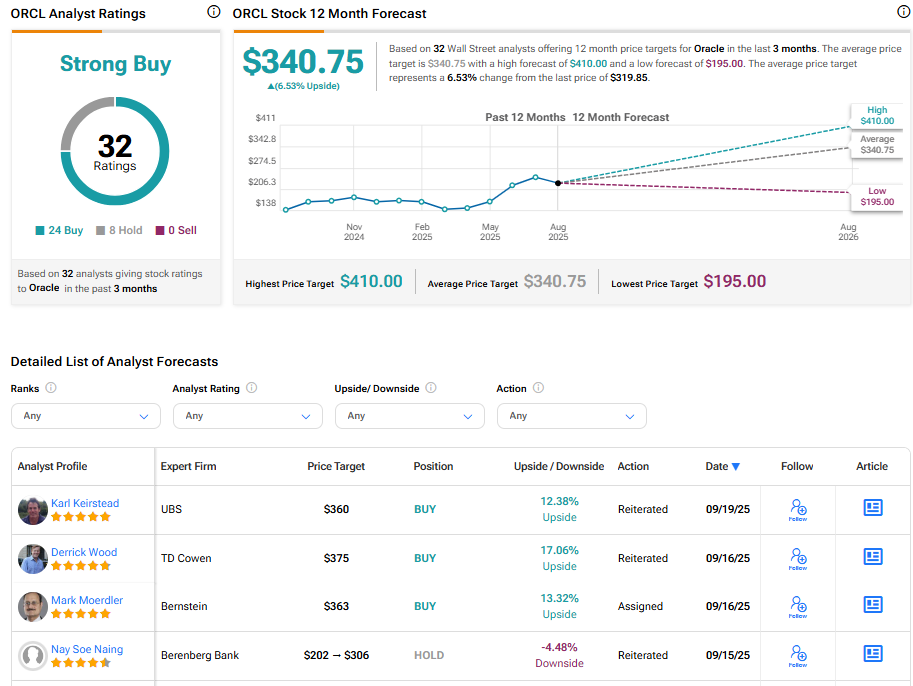

Turning to Wall Street, analysts have a Strong Buy consensus rating on ORCL stock based on 24 Buys and eight Holds assigned in the past three months. Further, the average Oracle price target of $340.75 per share implies 6.29% upside potential.