Like a bee raging towards a beehive, analysts have flocked to Oracle (NYSE:ORCL) stock with raised price targets after the company reported favorable Q4 earnings yesterday. Analysts are overwhelmingly bullish on the stock, finding it an attractive pick.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For its fourth quarter, Oracle’s earnings and revenues beat analyst estimates, with sales expanding 16.9% year-over-year supported by a 23% surge in cloud services and license support revenue. Infrastructure (IaaS) also experienced a 77% growth in Q4. Looking ahead, Q1 adjusted earnings are seen between $1.12 to $1.16 per share (growth of 9% to 13%) with an 8% to 10% revenue growth.

In pre-market trade today, Oracle stock gained 5.2%. Year-to-date, the stock gained 40%, and in single-day trade yesterday, the stock accumulated 6%.

Should I Buy Oracle Stock Now?

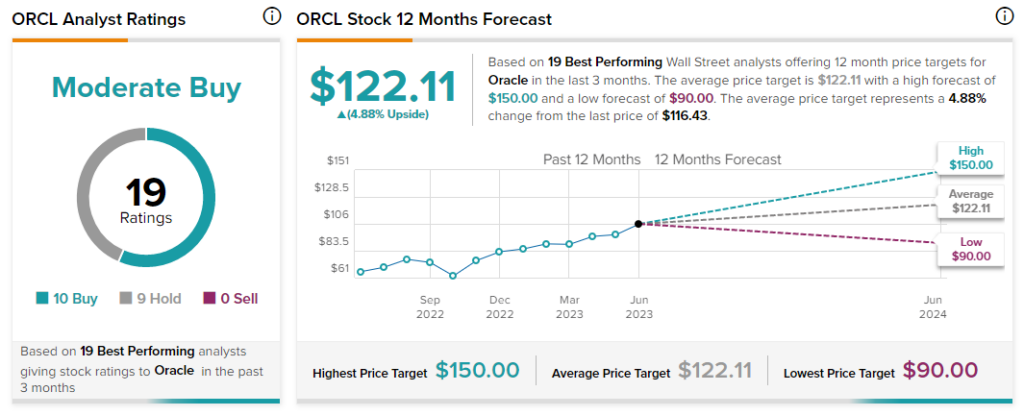

Of the 19 Top Wall Street Analysts covering the stock, 10 rate it a Buy while nine assigned a Hold rating on the stock. With consensus Moderate Buy rating, the average price target stands at $122.11, implying a 4.9% upside potential.

Goldman Sachs Analyst Kash Rangan upgraded Oracle to Hold from Sell today with a significant jump in price target to $120 from $75 post its attractive Q4 results.

Mizuho Securities Analyst Siti Panigrahi maintained a Buy rating and raised his price target by 29.3% to $150 stating that the investors continue to underestimate Oracle’s potential over the medium term to generate solid sales and cash flow growth and exceed its FY26 targets.

In the pack of analysts raising price targets today after the computer technology company reported a spectacular earnings quarter, Deutsche Bank Analyst Brad Zelnick pushed price target higher by 12.5% to $135 from $120 amid string fiscal Q4 results. He notes that as the company expects to sustain its 30% cloud growth rate in FY24, stock price trading is seen on the higher side. Based on TipRanks’ analysis, Brad has an 83% success rate on Oracle coverage with an average return per rating at 22.2%.

Additionally, Barclays Analyst Raimo Lenschow maintained his Buy rating with a raised $126 price target (vs. $113 earlier) indicating an 8.2% upside potential. He mentions that rising cloud revenue and management providing more of a framework around the artificial intelligence opportunity leads to a growth trajectory. Also, with raised capex expectations for the upcoming year, investors will be looking forward to the long-term story and higher multiples.

On similar lines citing a favorable Q4, Wolfe Research and Jefferies raised their price targets on the stock, by 8% each, to $140 and $135 respectively.