Software giant Oracle (NASDAQ:ORCL) recently turned in its earnings report, and it went quite well for the firm. Better yet, the gains are still coming in Tuesday afternoon’s trading, with Oracle up slightly. The earnings report was definitely a major reason, but there’s more going on here than that.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Not long after Oracle posted its fourth quarter results, a wave of analysts stepped in to mark their positions on Oracle. Several raised price targets on the stock. However, one in particular—Goldman Sachs—hiked Oracle stock from Sell to Hold. The biggest reason? That fourth-quarter earnings report. Apparently, the results Oracle turned in removed a lot of the concerns that originally pushed Oracle to a Sell in the first place. So with those concerns removed, there was really no reason not to bump back up.

And it got better from there. Oracle set the stage for its first quarter figures by announcing a new partnership effort with Cohere. Cohere serves as an artificial intelligence platform that works at the enterprise level. More specifically, Cohere helps automate processes, which makes for better decision-making thanks to faster and clearer information flow. Cohere recently raised an extra $270 million in a series C funding round, of which Oracle was a part. Further, Oracle will offer up the Oracle Cloud Infrastructure to serve as a base for any generative AI developments.

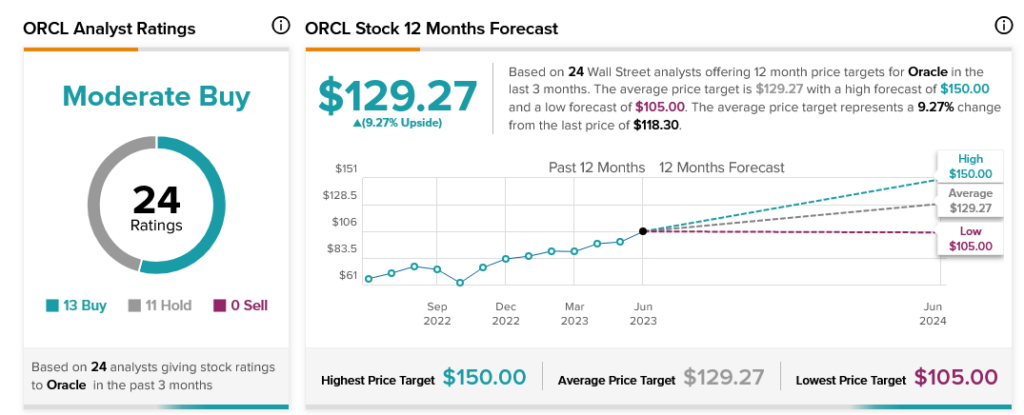

There are still doubts among analysts, and even after the last quarter, there’s still a clear division among them. With 13 Buy ratings and 11 Holds, Oracle stock is considered a Moderate Buy. Plus, with an average price target of $129.27, it offers investors 9.27% upside potential.