Options traders are bracing for a potential $207 billion swing in Alphabet’s (NASDAQ:GOOGL) market value as the tech giant prepares to release its third-quarter earnings after Wednesday’s closing bell. Based on current options pricing, traders are betting on a move of ~6.6% in either direction once the results are out.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While option traders are pricing in a major move, analysts aren’t sitting idle either. Ahead of Wednesday’s report, KeyBanc analyst Justin Patterson lifted his price target on GOOGL to $300 (from $265) while reiterating his Overweight (i.e., Buy) rating. (To watch Patterson’s track record, click here)

Patterson’s bullish stance centers on what he sees as accelerating product momentum across Alphabet’s ecosystem. In his words, “faster product velocity is driving momentum in Search, Cloud, and Waymo.” That’s the core of his thesis – Google’s growth engines are not just firing on all cylinders, they’re picking up speed.

Patterson fine-tuned his model to capture both the upside in Alphabet’s core operations and a few one-off factors. He nudged his 3Q25 Search forecast higher to reflect stronger monetization improvements, while trimming estimates to account for a European Commission fine. Overall, the analyst expects Alphabet to post earnings per share of $2.95 for the quarter, noting that the company’s “combination of 12–13% annual revenue growth, operating leverage, and share repurchases should fuel ~17% annual EPS growth (2024–2027E).”

That kind of growth, according to Patterson, isn’t fully reflected in the current valuation. Alphabet trades at roughly a “~1.5x NTM P/E premium to the S&P 500 (24.5x vs. 23.0x),” a gap the analyst considers modest given the company’s scale and margin profile. “GOOGL’s valuation does not appear demanding,” he wrote, adding that his bullish stance rests on both near-term catalysts and a long runway for AI-driven revenue expansion.

In terms of what Patterson will be watching for in the print, Search remains front and center. The analyst projects “Search posting >12% y/y growth,” supported by stable query trends and improving ad monetization. He estimates Search revenue at about $55.5 billion, roughly 1% above Street forecasts. Patterson also sees room for upside surprises from YouTube and Cloud, particularly as the latter benefits from easing data center constraints.

On Cloud specifically, Patterson pointed to management commentary suggesting the business could re-accelerate into next year: “Microsoft’s recent comment on data center constraints persisting into 2026 suggests that Google Cloud’s growth could still vary each quarter. We view this as more of a timing issue vs. a structural problem.” The analyst also highlighted Waymo’s growing traction and Gemini’s December expansion as incremental positives for the AI narrative.

Despite the stock’s 42% rally this year, Patterson believes that Alphabet’s story is far from played out.

“As these businesses scale, we see a combination of positive earnings revisions and likely some lift to the P/E multiple. Net, we are mindful of recent performance but still believe there are plenty of reasons to stay bullish on GOOGL,” the analyst summed up.

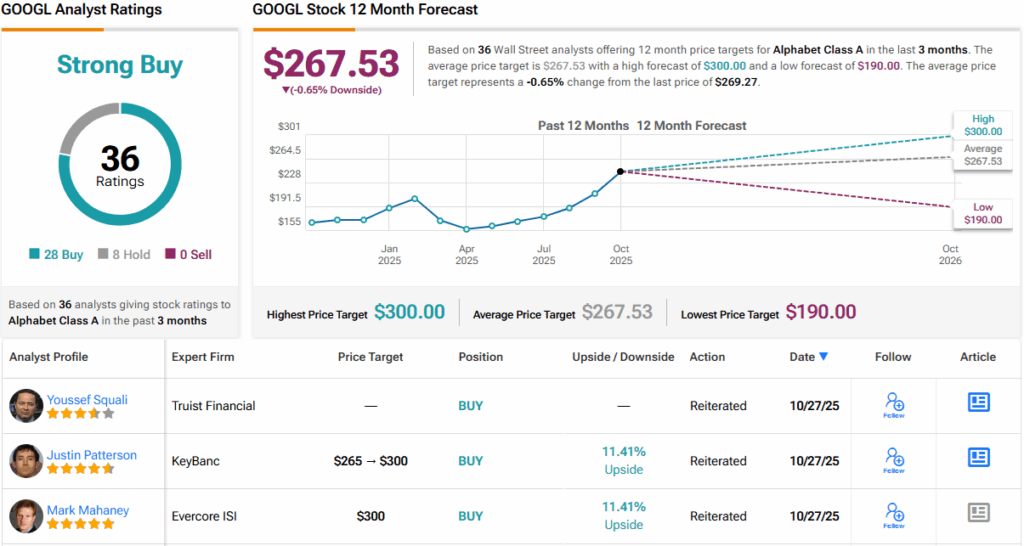

That’s KeyBanc’s take – but what about the rest of Wall Street? The picture is somewhat mixed. Of the 36 analysts following the stock, 28 rate GOOGL a Buy and 8 suggest a Hold, giving it a Strong Buy consensus overall. Still, after such a powerful run, the Street’s average price target of $267.53 suggests the shares may trade sideways in the near term. It’ll be interesting to see if analysts revisit their targets once the earnings results are in. (See GOOGL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.