After plummeting nearly 29% on Friday, shares of web browser and news services provider Opera (NASDAQ:OPRA) are in focus today amid the company’s planned stock sale of nearly $300 million.

Interestingly, Opera itself is not expected to receive any funds from the mixed-shelf offering, and selling investors are anticipated to offload nearly 141.7 million shares.

After the steep sell-off, today, the company has clarified that the filing will not mean any actual sale or issue of its shares but provides an opportunity for its pre-IPO investors to carry out the offerings over a period of the next three years.

Additionally, Kunlun Tech which holds nearly 128 million Opera shares has notified the company that it does not plan to sell any Opera ADSs (American Depository Shares) in the open market and has committed to not carry out any sales over the next 12 months as well. Importantly, Kunlun has been Opera’s cornerstone shareholder since 2016.

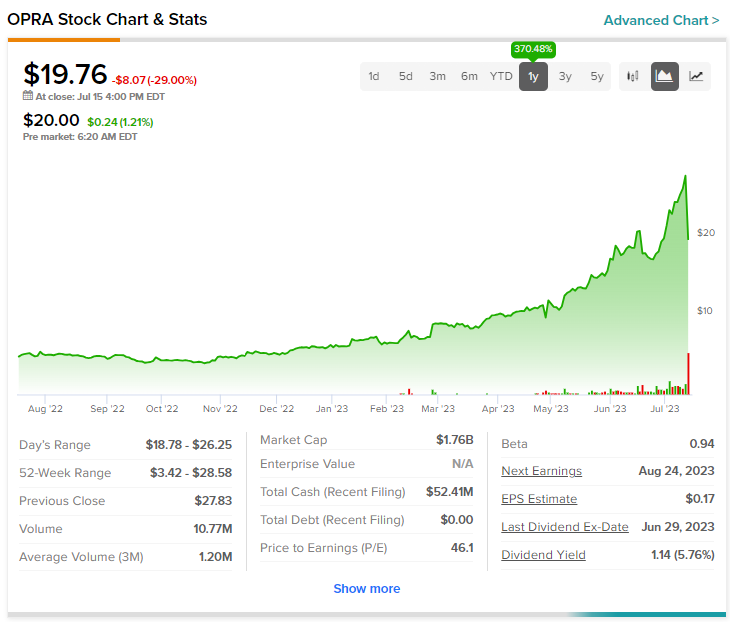

Despite the recent selloff, Opera shares still remain nearly 370% higher over the past year. At the same time, short interest in the stock now stands at about 6.2%.

Read full Disclosure