Microsoft-backed (MSFT) OpenAI (PC:OPAIQ) isn’t planning to go public anytime soon. Even though the AI firm has huge financial needs, it seems content to stay private and avoid the pressure of constant reporting and investor scrutiny that come with being publicly traded, according to Yahoo Finance. Instead, OpenAI is trying to win public and government support by presenting itself as a strategic national asset that the U.S. should protect. However, that effort has brought unwanted attention and confusion, especially after recent comments from its executives led to controversy.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In fact, at a Wall Street Journal event, Chief Financial Officer Sarah Friar said that OpenAI wanted the U.S. government to provide “loan guarantees,” which some interpreted as a bailout funded by taxpayers. The backlash was quick, which led Friar to clarify on LinkedIn that she had misspoken and that her comment was misunderstood. Soon after, CEO Sam Altman also denied that the company was seeking any kind of financial backstop from the government.

Nonetheless, the timing was awkward, as OpenAI was already under pressure to explain how it plans to fund its $1 trillion spending goal. That tension boiled over in a podcast last week when investor Brad Gerstner asked Altman how OpenAI could afford such massive spending. Altman appeared irritated by the question and shot back, “Brad, if you want to sell your shares, I’ll find you a buyer.” The clip quickly spread online, and while Friar said the company isn’t working on an IPO and is focused on growth, the exchange fueled concerns that AI companies like OpenAI may be taking on more than they can handle.

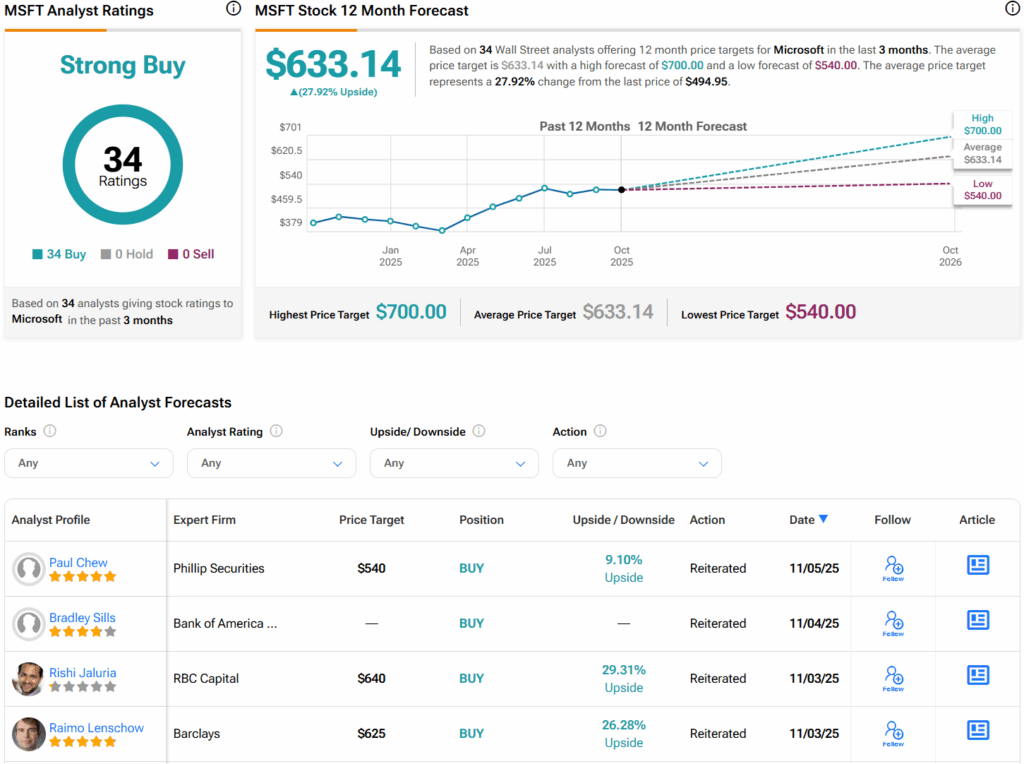

Is MSFT Stock a Buy?

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 34 Buys assigned in the last three months. Furthermore, the average MSFT price target of $633.14 per share implies 28% upside potential.