Microsoft-backed (MSFT) artificial intelligence (AI) start-up company OpenAI has raised $6.6 billion in its latest funding round.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The new funding is based on a valuation of $157 billion for privately held OpenAI. The company was last valued at $86 billion earlier this year. In an October 2 blog post, the company said that it will use the money raised to further its leadership in AI research and increase its computing power.

OpenAI didn’t publicly name who participated in this latest funding round. However, media reports say that tech giants Microsoft and Nvidia (NVDA) each invested in the company behind ChatGPT. Microsoft is the single largest investor in OpenAI, having plowed more than $13 billion into the company. Venture capital firms Thrive Capital and Khosla Ventures also participated in this funding round.

Structural Changes at OpenAI

The closing of the newest funding round comes as OpenAI restructures into a for-profit company, shifting from its previous nonprofit status. That change in corporate direction has led to a wave of executive departures at OpenAI. Longtime Chief Technology Officer (CTO) Mira Murati resigned last week, becoming the latest senior executive to depart.

The structural shift at OpenAI comes as the company continues to grow rapidly and lose money. It was recently reported that OpenAI is on track to generate $3.6 billion in revenue this year but post a loss of more than $5 billion. Still, the company’s valuation has skyrocketed amid the frenzy over AI applications.

Following the latest funding round, OpenAI’s valuation has risen from $14 billion in 2021 to $157 billion today. The company has reportedly told investors that its main goals are to ramp-up the commercialization of its AI systems and achieve profitability.

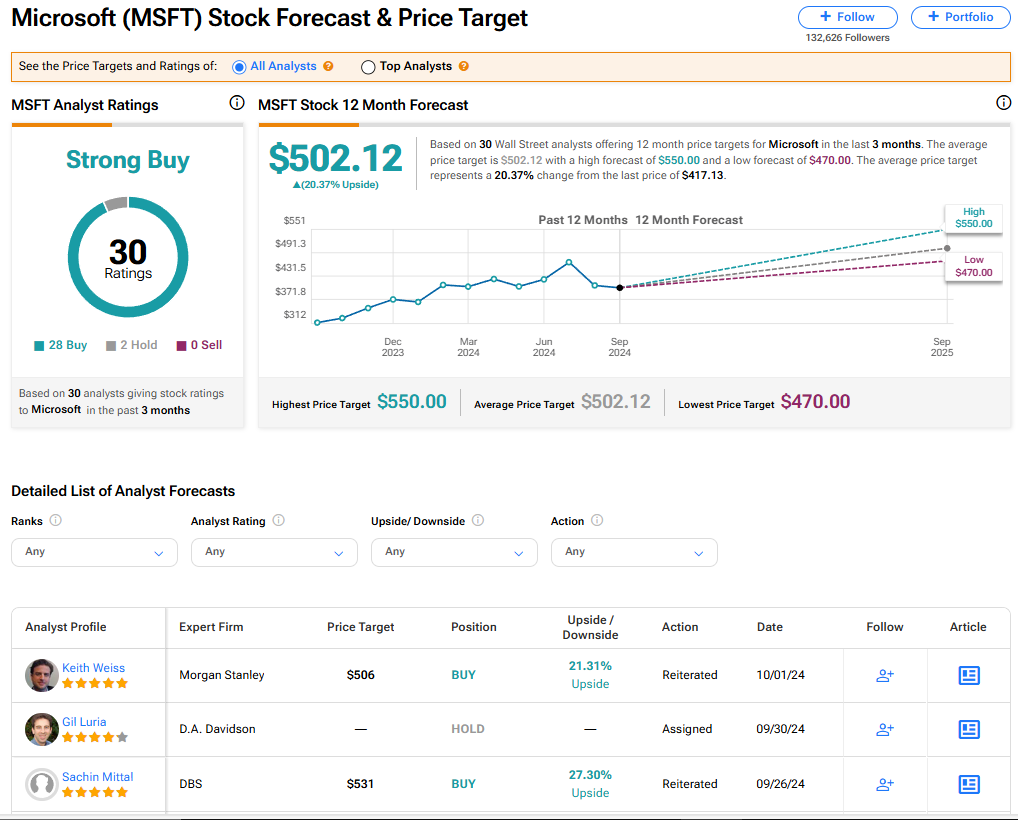

Is MSFT Stock a Buy?

Microsoft stock has a consensus Strong Buy rating among 30 Wall Street analysts. That rating is based on 28 Buy and two Hold recommendations made in the last three months. There are no Sell ratings on the stock. The average MSFT price target of $502.12 implies 20.37% upside potential from current levels.