Microsoft-backed (MSFT) AI firm OpenAI is quickly becoming one of the stock market’s most influential companies despite being a private company, according to Bloomberg. Indeed, just last week, the company launched a “buy” button inside ChatGPT that caused e-commerce stocks like Shopify (SHOP) and Etsy (ETSY) to jump. Then, it shared a blog post about internal tools that can help with research, customer support, contract searches, and personalized sales responses, which led to a decline in software stocks like Atlassian (TEAM).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It’s worth noting that it’s unusual for a private startup, even one valued at $500 billion, to have this much market-moving power. But investors are now watching OpenAI’s announcements as closely as they would news from Apple (AAPL) or Nvidia (NVDA). That’s why OpenAI’s annual DevDay conference, held in San Francisco, is drawing so much attention. Investors expect updates on new AI tools, such as a smarter travel booking assistant or an AI-powered web browser. If OpenAI enters new areas, that could boost its partners or infrastructure providers, but hurt companies already in those markets.

In addition, five-star UBS (UBS) analyst Karl Keirstead noted that with the high cost of running ChatGPT, OpenAI is likely to try to grow beyond just subscriptions. That’s why traders are eager to get clues about what’s coming next — especially since any new feature could disrupt entire industries or give investors a new stock to bet on. With over 700 million ChatGPT users, $4.3 billion in revenue in the first half of 2025, and a $2.5 billion loss, OpenAI is moving fast and taking risks.

Is MSFT Stock a Buy?

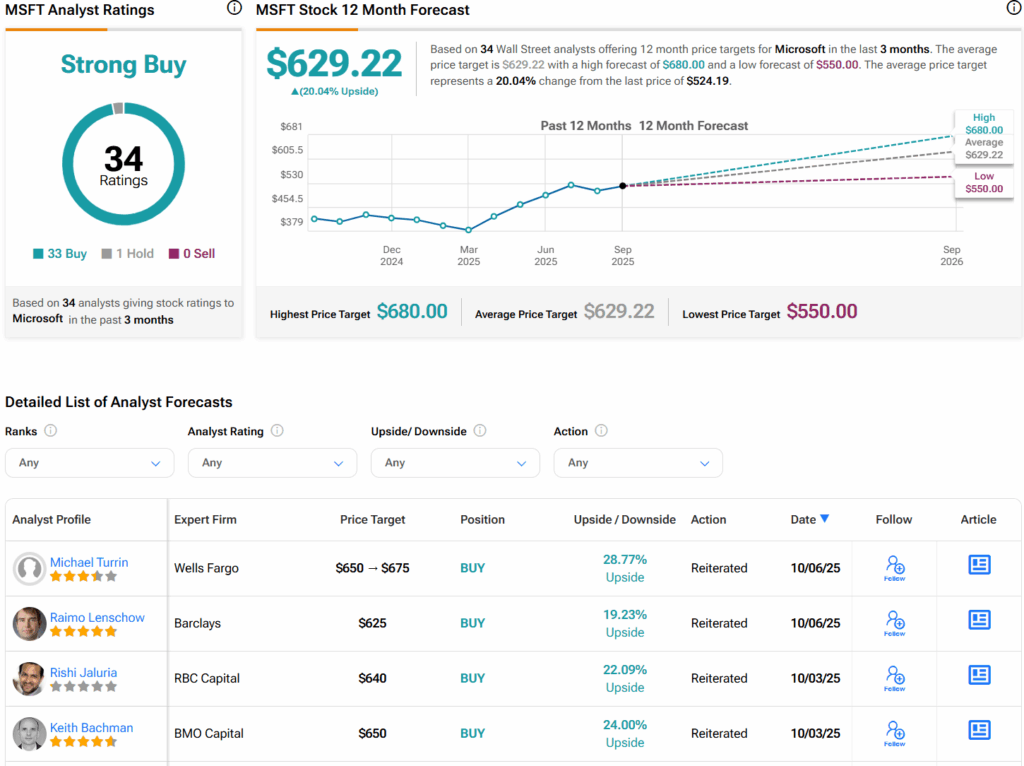

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 33 Buys and one Hold assigned in the last three months. Furthermore, the average MSFT price target of $629.22 per share implies 20% upside potential.