ChatGPT maker OpenAI (PC:OPAIQ) is planning to go public in late 2026 or early 2027, targeting a massive valuation of $1 trillion to finance its ambitious artificial general intelligence (AGI) goals. According to Reuters, the company is preparing for the initial public offering (IPO) with hopes to raise at least $60 billion. However, sources say discussions are in very early stages, and the timing and valuation may change.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

From the start, OpenAI’s mission has been to develop AGI, a technology superior to current artificial intelligence (AI) that can outperform most human tasks with high efficiency. An OpenAI spokesperson emphasized that the IPO is not the company’s main focus. Instead, “We are building a durable business and advancing our mission so everyone benefits from AGI.”

Why Does OpenAI Want to Go Public?

Simply put, an IPO would help the company raise money more easily and enable bigger acquisitions with public shares, supporting CEO Sam Altman’s plan to invest trillions in AI infrastructure. Although OpenAI’s revenues are rising rapidly, so are its losses. According to the current annualized run rate, revenues are expected to reach $20 billion by the end of 2025.

Developing new technology requires billions of dollars in investment, and even OpenAI needs substantial funding. Altman noted at a recent event that the company plans to spend $1.4 trillion on AI infrastructure. In addition to raising funds through investors and loans, he said an IPO is the most likely way to secure more financing.

OpenAI intends to file registration documents with the Securities and Exchange Commission (SEC) in the second half of 2026, with CFO Sarah Friar indicating a planned IPO in 2027.

OpenAI’s Restructuring Paves the Way for an IPO

On October 27, OpenAI reached a successful restructuring deal with one of its largest backers, Microsoft (MSFT), offering the tech giant a 27% stake in OpenAI PBC (public benefit corporation). The two companies had been at an impasse on restructuring terms, hindering OpenAI’s IPO plans.

Under the new corporate structure, OpenAI is still overseen by a nonprofit called the OpenAI Foundation, which owns 26% of OpenAI Group and can earn more shares if the company reaches certain goals. This setup ensures the nonprofit remains a major beneficiary of OpenAI’s financial success. If successful, OpenAI’s IPO will be the largest to date, making history for the ChatGPT maker.

Which Is the Best AI Stock?

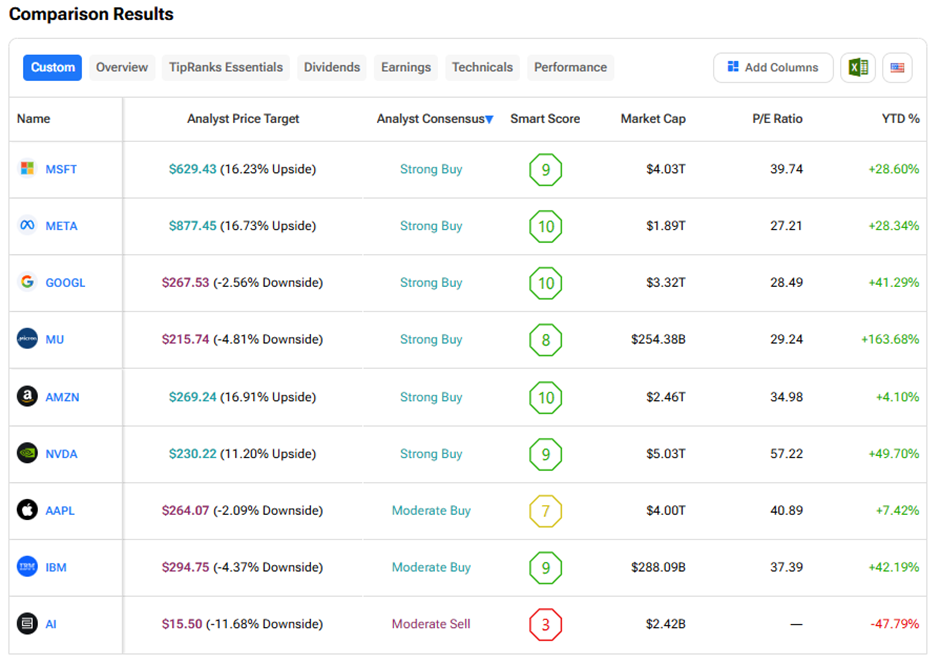

We used the TipRanks Stock Comparison Tool for the Best AI Stocks to determine which company is preferred by analysts.

Currently, Wall Street has assigned a “Strong Buy” consensus rating to Microsoft, Meta (META), Alphabet (GOOGL), Micron (MU), Amazon (AMZN), and Nvidia (NVDA). Out of these, AMZN stock offers the highest upside potential over the next 12 months.