Microsoft (MSFT)-backed OpenAI is expanding its operations in South Korea, aiming to tap into the Asian country’s fast-growing subscriber base. The artificial intelligence (AI) company announced on Monday that it is opening its first office in Seoul amid rising demand for its ChatGPT service. OpenAI has already established a local business entity in the country.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

OpenAI Makes Strategic Entry into Seoul

Interestingly, South Korea is OpenAI’s second-largest paying subscriber base for ChatGPT, after the U.S. The company is following its users, aiming to offer better services by establishing a local office. Additionally, OpenAI has begun hiring employees within the country to harbor strong relationships and partnerships. OpenAI is expected to reveal more details about the new office and its collaborations with Korean businesses in the forthcoming months. Earlier this year, OpenAI had announced its plan to develop AI products for South Korea’s chat app operator, Kakao.

Commenting on the news, OpenAI’s Chief Strategy Officer, Jason Kwon, stated that South Korea offers a favorable environment with a full-stack AI ecosystem. Kwon highlighted the country’s wide-ranging AI ecosystem, which includes everything from advanced silicon chips to state-of-the art software, and a user-base ranging from students to seniors, making it a highly promising market.

Kwon is also visiting Seoul to meet with officials from both the main opposition Democratic Party and ruling People Power Party as part of OpenAI’s expansion plans. The step underscores OpenAI’s ambition to expand internationally by localizing services, as it has done in cities like Paris, London, and Tokyo.

Which Is the Best AI Stock to Buy Now?

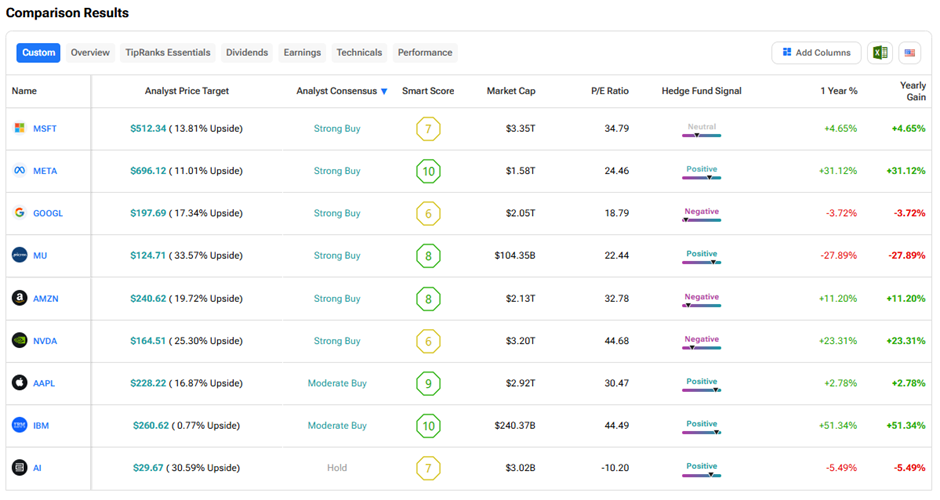

We used TipRanks’ Stock Comparison Tool for Best Artificial Intelligence Stocks to determine which stock is most favored by analysts. Investors can invest in any of these stocks after thorough research.

Currently, Microsoft, Meta (META), Alphabet (GOOGL), Micron (MU), Amazon (AMZN), and Nvidia (NVDA) have earned Wall Street’s “Strong Buy” consensus rating, with MU stock offering the highest upside potential among them.