Shares of onsemi (NASDAQ:ON) slid in trading on Monday after the chip maker’s Q4 guidance left investors disappointed. In the fourth quarter, the company has guided for adjusted revenues in the range of $1.95 billion to $2.05 billion with adjusted diluted earnings anticipated to be between $1.13 to $1.27 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For reference, analysts were expecting earnings of $1.36 per share on revenues of $2.18 billion.

In the third quarter, onsemi reported adjusted earnings of $1.39 per share as compared to $1.45 per share in the same period last year and above analysts’ consensus estimate of $1.34 per share. The company posted revenues of $2.18 billion, beating analysts’ expectations of $2.15 billion.

Is onsemi a Good Stock to Buy?

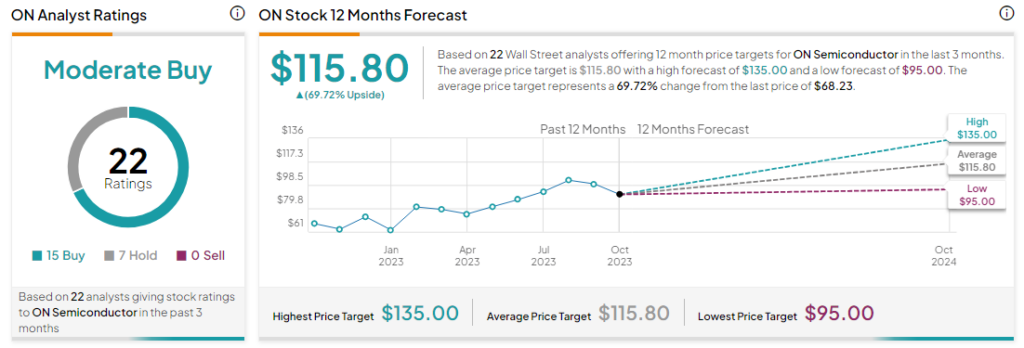

Analysts are cautiously optimistic about ON stock with a Moderate Buy consensus rating based on 15 Buys and seven Holds. The average onsemi price target of $115.80 implies an upside potential of 69.8% at current levels.