For a while, many were wondering if digital advertising was going to take some serious hits in an era where consumers are spending a lot less than before. But for social media platform Pinterest (NASDAQ:PINS), it seemed like less of a problem than anyone really thought. In fact, with signs that advertising is making a comeback, Pinterest was up nearly 2% in Friday afternoon’s trading session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Evercore suggested that the ad market was on its way back, and leading the way was Pinterest’s connection with Amazon (NASDAQ:AMZN), which put a lot more juice into its own advertising on the platform. That combined effort, Evercore’s Mark Mahaney noted, was a serious step in the right direction for Pinterest and prompted a hike in both estimates and target price accordingly. Indeed, Mahaney noted that six of Pinterest’s leading categories featured Amazon ads in about 30% of cases.

There’s More Going on than That

That alone is good news for virtually anybody, but there’s more going on under the hood. For instance, reports suggest that options trading is growing more bullish around the stock. And not so long ago, Pinterest also opened up an entire pop-up store geared toward its 2024 trends predictions, which are, by the way, also shoppable in and of themselves. That combination of growing investor sentiment coupled with new and aggressive pushes toward getting more users shopping, buying, and leaving a cut for Pinterest might pay off well in the end. Of course, with the consumer a bit battered these days—don’t forget how much of Christmas 2023 was a buy now pay later affair—that may not pay off as hoped. But it’s certainly worth a try if nothing else.

Is Pinterest a Good Company to Invest In?

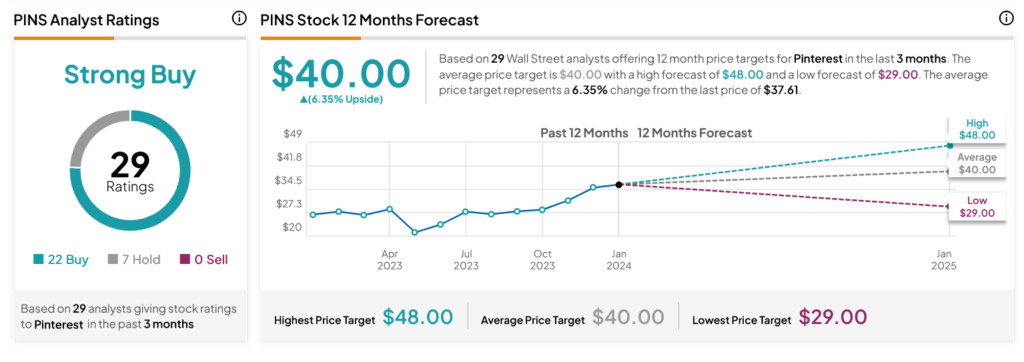

Turning to Wall Street, analysts have a Strong Buy consensus rating on PINS stock based on 22 Buys and seven Holds assigned in the past three months, as indicated by the graphic below. After a 40.82% rally in its share price over the past year, the average PINS price target of $40 per share implies 6.35% upside potential.