Amazon’s (NASDAQ:AMZN) entrant in the streaming wars, Amazon Prime, just got a significant boost after a year of struggle with Warner Bros Discovery (NASDAQ:WBD). The two companies announced an end to the negotiations that concluded successfully with HBO Max returning to Amazon Prime Video Channels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Under the terms of the deal, Amazon Prime customers can once more sign up to receive access to HBO Max, which includes titles such as “Mare of Easttown” and the surprisingly popular “Harley Quinn” series, which recently concluded its third season.

Further, once the combined HBO Max / Discovery streaming service is activated, customers will be automatically enrolled in that streaming service, which should launch sometime in the spring of 2023.

The news is undoubtedly welcomed by streaming customers who want an easy access point for HBO Max. However, the market perhaps considers this move too little too late. With inflation eating at consumer disposable income, it’s unclear how many will come back. Amazon was down 2.47% in afternoon trading. It was even worse for Warner Bros. Discovery, which was down 3.86%.

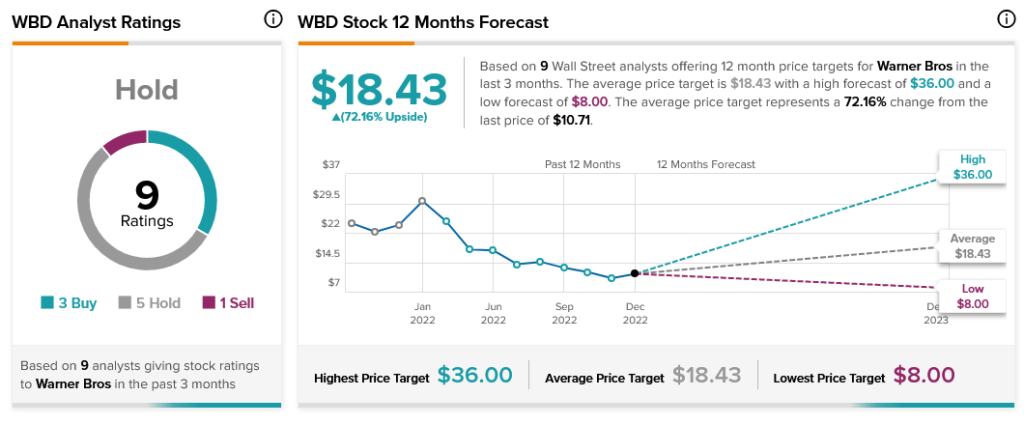

Amazon is much more likely to survive the fallout than Warner Bros Discovery is, however. A quick comparison of the two companies’ analyst consensus figures makes it clear. Amazon is a Strong Buy. Meanwhile, Warner Bros Discovery is merely a Hold.

Warner depends on deals like this to go through for its mere survival. For Amazon, however, this is a sideshow it could stop tomorrow and still carry on as a functioning concern.