With cloud storage stock Snowflake (NASDAQ:SNOW) poised to report earnings in a matter of days, already analysts are looking at the future. And the future is not all bad for Snowflake, even though it’s down fractionally in Monday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The less-than-dismal forecast came from Monness, Crespi, Hardt analyst Brian White. White noted that Snowflake should present some stronger product growth in the near term, though cautioned potential investors about “softer seasonality” when it turns in its latest data. White is looking for Snowflake to turn into a blizzard, posting $682.8 million in revenue, which would represent $0.14 per share in earnings. Should White’s numbers come to pass, it would be a solid beat above analyst consensus, which is looking for $662.13 million in revenue against $0.10 per share in earnings.

Snowflake has been rapidly picking up steam in the last few years, adding a string of major new clients to its operations—from PepsiCo (NASDAQ:PEP) to Adobe (NASDAQ:ADBE) and beyond. It’s also working on developing new products, with a particular focus on the increasingly-popular artificial intelligence. However, reports noted that George Soros recently sold a substantial quantity of Snowflake stock in favor of other AI developers, particularly Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD).

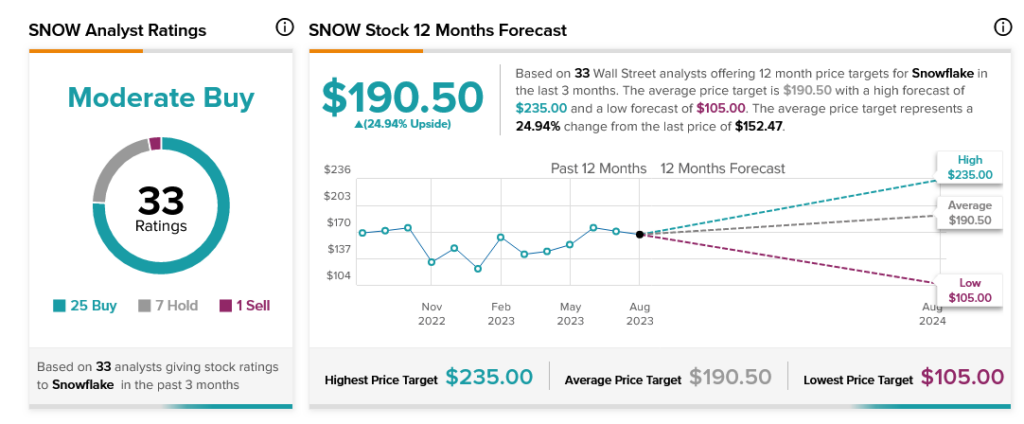

Soros aside, much of the analyst community looks for big things out of Snowflake. Snowflake stock is currently considered a Moderate Buy, thanks to 25 Buy ratings, seven Hold and one Sell. Further, Snowflake stock comes with a 24.94% upside potential thanks to its average price target of $190.50.