Palantir (NASDAQ:PLTR) stock has been the envy of Wall Street, standing out as one of the rare AI names to post a sharp rally in 2025. With trade and tariff fears receding, PLTR has surged 64% year-to-date – and it’s not showing signs of slowing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Still, the ride hasn’t been without turbulence. Concerns over tightening budgets—both from commercial clients and government agencies—pose a real threat to Palantir’s growth story. Case in point: when the U.S. Department of Defense floated an 8% budget cut, PLTR shares took a noticeable hit.

But if Palantir’s recent performance is any indication, it’s powering through the noise. The company has racked up a string of high-profile deals, partnering with giants like Qualcomm and securing business with NATO.

Could more good news be around the corner on Monday, May 5 when PLTR unveils its Q1 earnings report?

One investor, known by the pseudonym Simple Investment Ideas, certainly thinks so. The 5-star investor isn’t just bullish on the quarter – he’s eyeing the trillion-dollar club as Palantir’s destination.

“Despite regulatory, dependency, and competition challenges, Palantir’s strategic evolution promises durable growth, high margins, and potential for a trillion-dollar valuation,” asserts Simple Investment Ideas.

The investor argues that PLTR is well on its way to becoming the backbone of critical industries due to its ability to offer a number of interconnected services. This strategic transformation will unlock enormous value on par with Microsoft’s position in the enterprise software space.

“This evolution underpins the latest bull case for Palantir: it is not just selling software to model a single enterprise, but is increasingly running the infrastructure that connects multiple enterprises,” Simple Investment Ideas opined.

In addition, the company is making strides in its go-to-market methods, shifting towards a SaaS-like model and away from customized, bespoke work for individual clients. This, according to the investor, will allow the company’s reach to expand to a wider swath of clients, while safeguarding (and even increasing) the already robust margins of ~80%.

“That is the path on which a trillion-dollar valuation becomes a credible possibility,” concludes Simple Investment Ideas,” who rates PLTR shares a Buy. (To watch Simple Investment Ideas’ track record, click here)

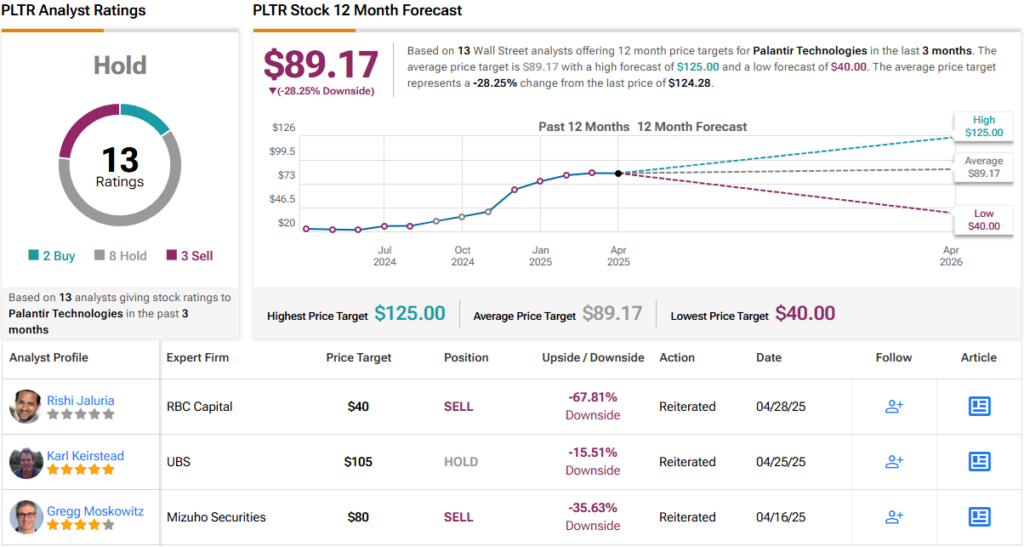

Wall Street, however, remains unconvinced. With 8 Hold ratings outweighing just 2 Buys and 3 Sells, analysts have landed on a Hold (i.e., Neutral) consensus rating. The average price target of $89.17 reinforces that caution, implying a potential downside of 28% over the coming year. (See PLTR stock forecast)

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.