Advanced Micro Devices (NASDAQ:AMD) flipped the switch earlier this year, delivering a sizzling performance that has sent its share price through the roof. Over the past six months, AMD’s share price is up a whopping 172%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company’s recent deal with OpenAI represented yet another feather in the chipmaker’s cap, providing plenty of support for surging revenues in the years to come.

Under the terms of the agreement, OpenAI will purchase six gigawatts worth of AMD’s GPUs beginning in the second half of next year. AMD CEO Dr. Lisa Su has predicted that the deal will eventually generate “double-digit billions” in annual AI data center sales.

However, after such a strong performance during the last half year, is it time for investors to take their foot off the gas pedal? Not according to one top investor known by the pseudonym Stone Fox Capital, who is confident that AMD’s momentum won’t be slowing down anytime soon.

“The OpenAI deal unlocks the massive AI potential with a partnership that unthinkably targets a $600+ stock price to fully unlock all of the benefits,” posits the 5-star investor, who is among the top 3% of stock pros covered by TipRanks.

While Stone Fox is excited by the expected dollars from the OpenAI deal, the investor is also eyeing additional revenue opportunities for AMD thanks to the stamp of approval it received from this major AI player.

“AMD CEO Lisa Su hinted at other revenue streams and deals potentially coming from this OpenAI agreement, leading to over $100 billion in total revenues from the deal,” adds Stone Fox.

The investor cites an Nvidia estimate that predicts the AI chip market will exceed $1 trillion by 2028. If AMD captures 20% of this bonanza, that would be equivalent to $200 billion in sales, Stone Fox emphasizes.

In other words, don’t be afraid to jump on board even after the most recent bull run.

“My investment thesis remains ultra-bullish on the stock, even at all-time highs, as the new deal places AMD on a much higher revenue trajectory,” sums up Stone Fox, who rates AMD a Strong Buy. (To watch Stone Fox Capital’s track record, click here)

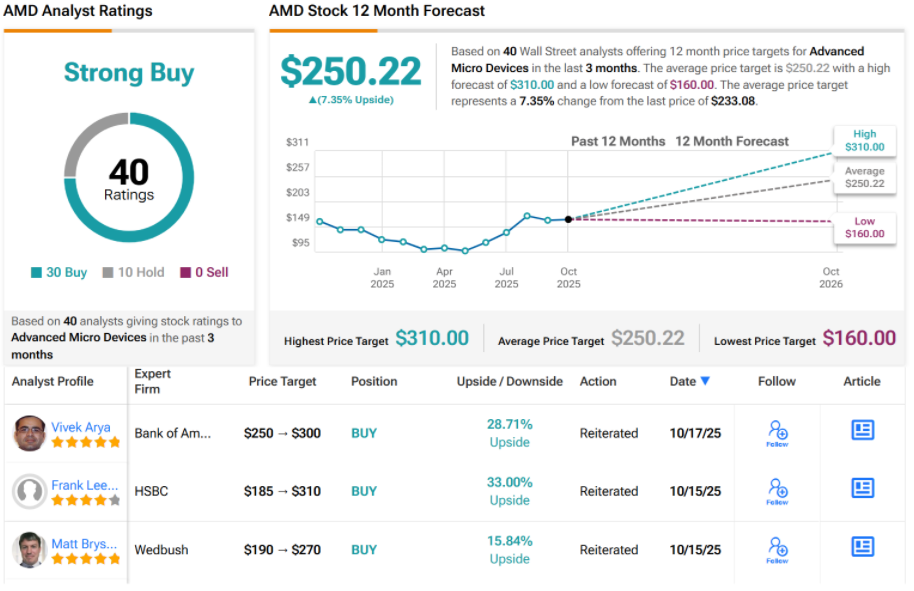

The overall sentiment on Wall Street is pretty confident as well. With 30 Buys and 10 Holds, AMD enjoys a Strong Buy consensus rating. Its 12-month average price target of $250.22 implies an upside of ~7%. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.