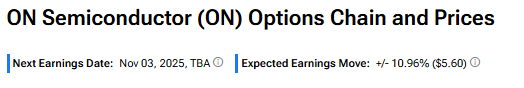

ON Semiconductor (ON) is gearing up to report its third-quarter earnings before the market opens on Monday, November 3. While analysts expect a year-over-year decline in both revenue and profit, options traders are betting on a big move. Based on options pricing, traders are bracing for a 10.96% swing in either direction. This is much higher than the chipmaker’s three-year average post-earnings move of -0.96%, which reflects a modest decline.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What to Watch in ON’s Earnings

The implied move in ON stock reflects rising uncertainty about its near-term outlook. Traders are watching for signs of stabilization in automotive demand, especially for silicon carbide (SiC) products that play a key role in the company’s EV strategy.

Investors are also eyeing updates on cost-cutting and restructuring efforts, as ON has faced margin pressure in recent quarters. Commentary on AI-related tailwinds will also be watched closely, as peers shift toward high-performance computing and data center markets.

Beyond that, investors will focus on inventory levels and management’s guidance for Q4 and early 2026.

Analysts’ Expectations from ON’s Q3 Results

Currently, analysts forecast Q3 earnings of $0.59 per share, down nearly 40% from the same quarter last year, and revenue of $1.52 billion, down 14%. The company’s performance has been hurt by continued weakness in auto and industrial markets, due to excess inventory and economic uncertainty.

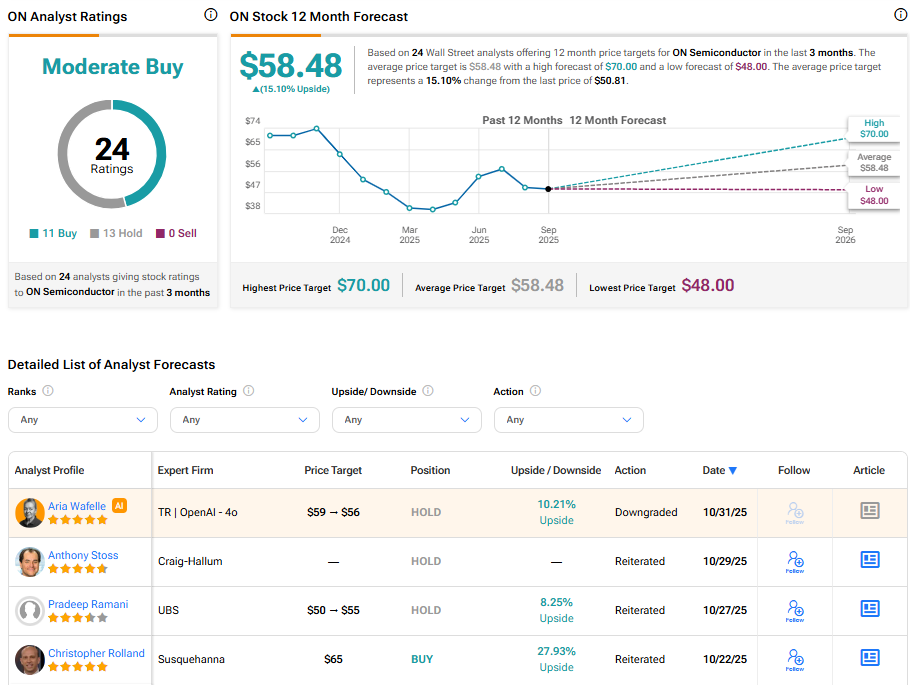

Ahead of the earnings release, UBS analyst Pradeep Ramani raised his price target for ON Semiconductor stock to $55 from $50 but maintained a Hold rating. He expects ON to report Q3 results in line with guidance and steady gross margins.

The analyst also noted a pattern where ON builds up inventory during the quarter and then cuts prices in the final month, which points to ongoing channel inventory issues with its parts.

Is ON Stock a Good Buy?

Currently, Wall Street has a Moderate Buy consensus rating on ON stock based on 11 Buys and 13 Holds. The average On Semiconductor stock price target of $58.48 indicates a 15.1% upside potential from current levels.