Normally, when a stock drops 13%, as shoemaker On Holding (NYSE:ONON) did in today’s trading, something very serious has gone wrong. A factory fire, scandal in the C-suite, or something similar is usually what it takes to spark a double-digit loss in share prices. This time around, though, it was all connected to currency issues. Specifically, the Swiss franc.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

On Holding recently turned in its earnings report, and by most indicators, the news was good. Very good, really; revenue was up 52.3% against the second quarter of 2022, which is always a feat. However, that huge surge in revenue came at about the same time that the Swiss franc proved strong, which effectively reduced earnings by making the cash received from other countries worth less in Swiss francs. And On Holding brought in plenty of cash from other countries; its Middle East and Africa sales were up 28.9% against this time last year, and its Asia-Pacific sales nearly doubled with a 90.2% gain.

So while this is bad news, it’s largely bad news outside of On Holding’s control. In fact, On Holding’s last earnings report was sufficiently solid that it hiked its outlook. Now, On Holding looks to bring in over $2 billion in sales for the 2023 fiscal year, or about 1.76 billion of those increasingly-valuable Swiss francs. That brings On Holding to a full-year growth rate of about 44%, all told, which is impressive by any standard. Particularly when we’re going into what could be called a soft economy. However, some believe that On Holding shares are already fairly highly-priced, so even with a solid outlook, there may yet be room to fall.

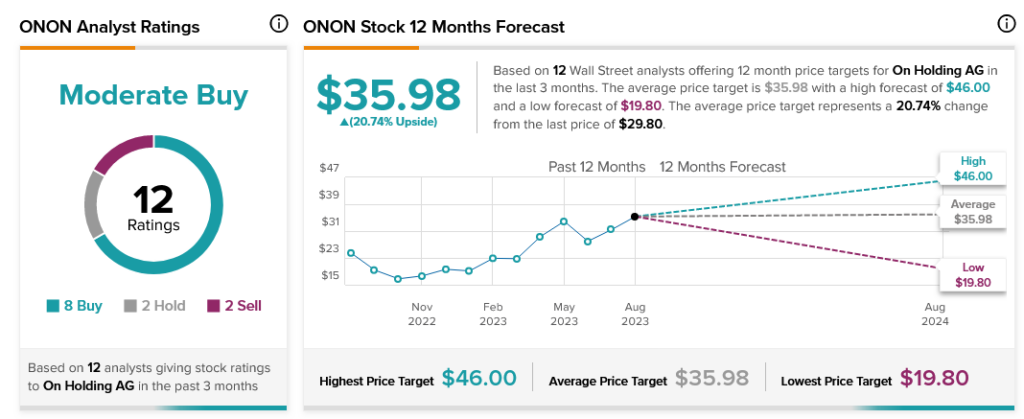

Despite this, most analysts believe On Holding is a worthwhile buy. In fact, analyst consensus calls it a Moderate Buy, with eight Buy ratings, two Hold and two Sell. Further, On Holding stock comes with a 20.74% upside potential thanks to its average price target of $35.98.