Media company Omnicom (NYSE:OMC) has agreed to purchase Flywheel Digital in an all-cash deal valued at $835 million to boost its e-commerce offerings. Flywheel, a cloud-based digital commerce platform, enables brands to sell products efficiently on online marketplaces including Amazon.com (AMZN), Walmart (WMT), and Alibaba (BABA).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The acquisition is expected to close in the first quarter of 2024. Also, it is subject to approval from the shareholders of Flywheel’s parent, Ascential (GB:ASCL), a UK-based business-to-business information company that provides insights, data, and digital content services.

Post-acquisition, Flywheel will be integrated within Omnicom, joining other fields like healthcare and precision marketing, and will be led by Duncan Painter, the current CEO of Ascential.

Omnicom’s CEO, John Wren, believes that the Flywheel acquisition should boost OMC’s reach in the growing digital commerce and retail media sectors. He expects global e-commerce sales to increase by 50%, reaching about $7 trillion by 2025.

Is OMC a Good Stock?

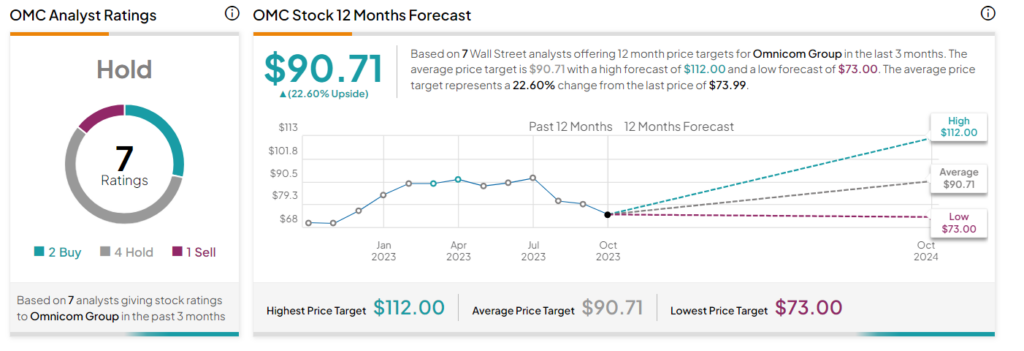

Omnicom stock sports a Hold consensus rating on TipRanks, based on two Buy, four Hold, and one Sell recommendations. Further, analysts’ average price target of $90.71 implies 22.6% upside potential. OMC stock has declined over 8% year-to-date.