Shares of Olaplex Holdings (NASDAQ: OLPX) tanked in pre-market trading on Wednesday as the technology-driven beauty company’s COO, Tiffany Walden resigned effective from October 18.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Walden will transition from her role as COO to a senior advisor to the Company “for the period of October 18, 2022, to December 31, 2022, unless her employment earlier terminates pursuant to the terms of the Separation Agreement.”

The company also lowered its FY22 guidance and now expects revenues to range between $704 million and $711 million versus its earlier guidance in the range of $796 million to $826 million.

This lowered guidance also assumes Olaplex’s Q4 revenues to decline by 20% year-over-year.

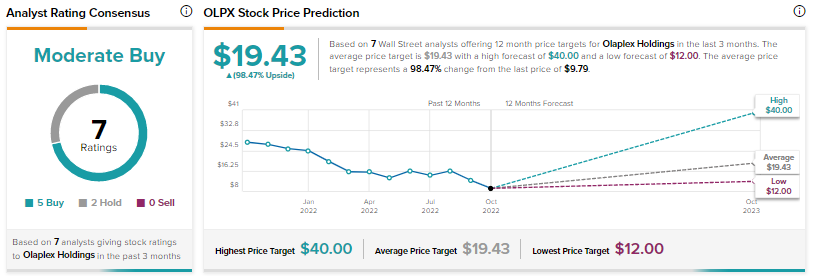

Analysts are cautiously optimistic about OLPX with a Moderate Buy consensus rating based on five Buys and two Holds. The average price forecast of $19.43 implies an upside potential of 98.5% at current levels.