Okta (NASDAQ:OKTA) stock is catching a bid today, but there could be more gains coming for patient investors. Even though Okta was the target of a security breach not long ago, I am bullish on OKTA stock because the company’s latest round of financial data suggests that Okta remains strong and resilient.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Okta provides a specific type of security product, primarily focused on identity authentication and access. For example, if a company wants to implement two-factor authentication for employees to access a workplace portal, the company might choose to use Okta’s services.

It’s not every day that Okta is a hot topic of conversation. In the cybersecurity field, other companies such as CrowdStrike (NASDAQ:CRWD) and Palantir (NYSE:PLTR) get lots of attention and praise. However, Okta is at the center of attention today. So, let’s see what all of the fuss is about.

OKTA Stock Gains 23%: What’s Going On?

OKTA stock is up 23% today, but when you look at the chart, you can see that there’s much more overhead room to the 2021 peak of nearly $300. What’s causing the market to favor Okta today, though?

There’s been a lot going on with Okta in recent days, and it’s generally positive. First of all, as TipRanks reported yesterday, Okta updated its online investor materials as well as the company’s communication channels. Furthermore, Okta disclosed several key appointment/promotions yesterday, including Eric Kelleher’s promotion to the role of president, Customer Experience & Communications at Okta.

That’s all fairly positive news, but it’s probably not enough to lift OKTA stock by 23% in a single day. Maybe investors are pleasantly surprised to learn that Okta received a couple of price-target hikes. According to TheFly, JPMorgan Chase (NYSE:JPM) analysts raised their Okta share-price target from $74 to $88, while Wells Fargo (NYSE:WFC) analysts lifted their price target on Okta shares from $70 to $90.

However, even those price-target hikes shouldn’t prompt such a big stock-price move today. Besides, the JPMorgan Chase and Wells Fargo analysts will probably end up revising their price targets higher since Okta shares now trade at more than $100. The real reason for OKTA stock’s rise was its recent earnings report.

Okta Posts Great Numbers, Even after the Security Breach

It was just a few months ago when Okta had to deal with the reputational damage of a security breach. As Barron’s reported, a “threat actor” gained prohibited access to the “names and email addresses of all users of Okta’s customer-support system.”

You might assume that, in the wake of this unfortunate incident, Okta would need at least a couple of quarters or maybe even a full year to recover. However, impressively enough, Okta just released a quarterly earnings report that’s positive enough to convince today’s stock traders to overlook the security breach.

For one thing, Okta’s total revenue grew by 19% year-over-year to $605 million in the fourth quarter of Fiscal Year 2024. This result beat the consensus estimate of $587.2 million in quarterly revenue. Moreover, Okta’s Subscription revenue of $591 million indicated a year-over-year increase of 20% — not too shabby.

Perhaps the security breach wasn’t enough to derail Okta in late 2023. When I checked Okta’s cash flow page on TipRanks, I noticed that the company’s free cash flow (FCF) seems to be improving over time. On that same topic, Okta CEO Todd McKinnon praised his company for achieving “record cash flow in the fourth quarter.” Drilling down to the numbers, Okta reported FCF of $166 million in Q4 FY2024, which is a huge improvement over the FCF of $72 million from the year-earlier quarter.

Finally, if you check Okta’s bottom-line results, you’ll notice that the company managed to deliver adjusted non-GAAP earnings of $0.63 per share, up by a whopping 110% year-over-year. Moreover, this result beat Wall Street’s consensus EPS estimate of $0.51 and added to Okta’s track record of consecutive quarterly EPS beats.

Is OKTA Stock a Buy, According to Analysts?

On TipRanks, OKTA comes in as a Hold based on seven Buys, 20 Holds, and one Sell rating assigned by analysts in the past three months. The average Okta stock price target is $89.83, implying 16.4% downside potential.

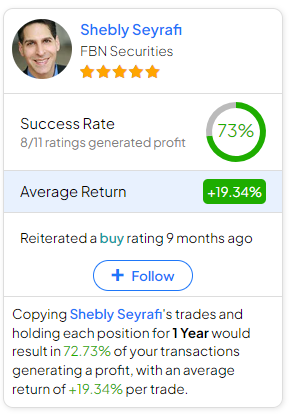

If you’re wondering which analyst you should follow if you want to buy and sell OKTA stock, the most profitable analyst covering the stock (on a one-year timeframe) is Shebly Seyrafi of FBN Securities, with an average return of 19.34% per rating and a 73% success rate. Click on the image below to learn more.

Conclusion: Should You Consider OKTA Stock?

Okta isn’t the only cybersecurity firm that can be traded on a major stock exchange, and companies like Palantir Technologies usually steal the spotlight. Today, however, the spotlight is shining on Okta because of the company’s improving cash flow as well as Okta’s excellent top- and bottom-line results.

So, don’t focus so much on Palantir that you end up overlooking the investment opportunity with Okta. After weighing the data, I am considering OKTA stock for my watch list today and imagine that it might eventually return to nearly $300.