WTI crude oil is down 0.40% to $90.12 today as of 10:48 a.m. EST. Prices are up 10% over the past month and just shy of the 52-week high amid tightening supply. At the same time, traders remain on edge with the U.S. Fed’s policy decision slated for later today.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Numbers from the American Petroleum Institute indicate a fall of nearly 5.2 million barrels in U.S. commercial stockpiles during the week ending September 15. Additionally, numbers from the Energy Information Administration (EIA) point to a decline of nearly 2.1 million barrels in crude inventories during the same period. In comparison, crude inventories had increased by about 4 million barrels in the prior week.

The Chairman and CEO of Chevron (NYSE:CVX), Mike Wirth, expects oil to move towards the $100 per barrel mark. The EIA expects oil production in the U.S. to drop to nearly 9.39 million barrels a day next month. Further, OPEC has moved to limit oil supply amid market volatility, and Saudi Aramco CEO Amin Nasser expects oil demand to rise to 110 million barrels a day by 2030.

Meanwhile, natural gas is down 3.52% to $2.75 today and remains nearly 38% lower year-to-date. Prices have gained nearly 7% over the past month on expectations of a rise in cooling demand.

Is USO a Good Investment?

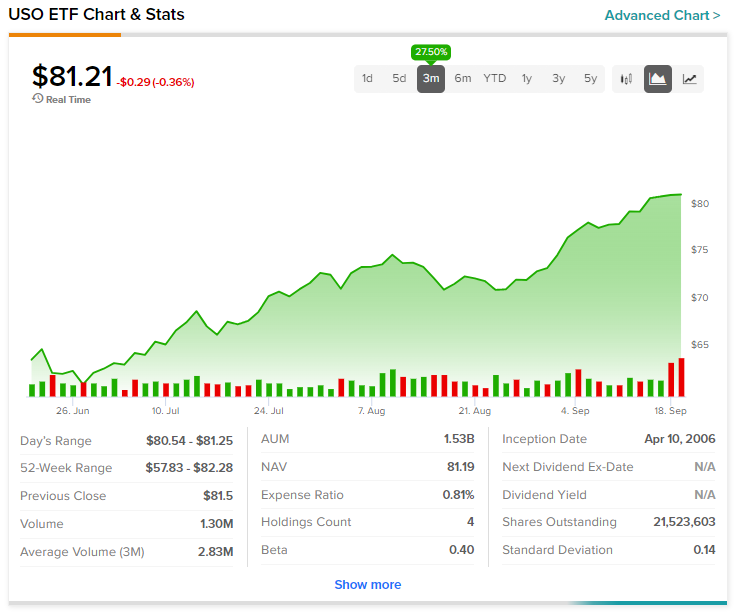

The United States Oil Fund ETF (USO) has gained nearly 27.5% over the past three months, and more gains could be in store if the supply tightness continues.

Click here to see a list of energy stocks that may be influenced by the latest developments in the energy markets.

Read full Disclosure