The benchmark crude WTI is up 0.40% to $69.14 at 11.21 a.m. EST ahead of the U.S. Fed meeting today. The central bank is largely expected to keep rates steady after a series of rate hikes over the past year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Oil prices are seeing strength this week after the People’s Bank of China lowered the rate on seven-day repurchase operations and the latest inflation print in the U.S. indicated prices are cooling which boosts the case for a rate pause today.

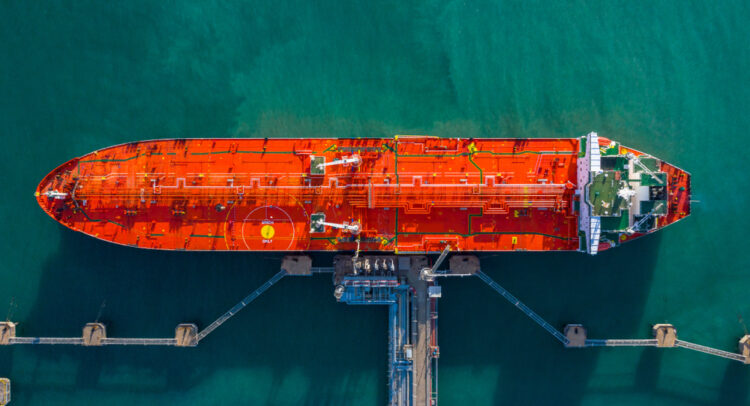

The latest numbers from the American Petroleum Institute indicate commercial oil inventories in the U.S. increased by 1.02 million barrels during the week ending June 9. The International Energy Agency now expects oil demand across the world to correct sharply by 2028 as the world moves ever closer to clean energy and EVs. The agency now sees global oil demand rising to 102.3 million barrels a day this year.

Further, numbers from the Energy Information Administration today indicate crude oil imports in the U.S. averaged 6.4 million barrels a day last week. Commercial crude inventories in the country rose by 7.9 million barrels during the week.

Meanwhile, natural gas is up 0.76% to $2.36 today but prices still remain nearly 47.6% lower so far in 2023.

At $62.27, the United States Oil Fund ETF (USO) is up nearly 0.21% in the morning session today already but still remains 29.7% lower over the past year. Here is a list of energy stocks that can be influenced by the latest developments in the energy markets.

Read full Disclosure