The benchmark crude WTI gained 1.96% to settle at $74.34 in today’s trading session and up more than 10% over the past three weeks after Prince Abdulaziz bin Salman, the Minister of Energy for Saudi Arabia advised energy short sellers to “watch out” at the Economic Forum in Doha recently.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The comments gain prominence after the recent production cuts from OPEC and its upcoming meeting next month. The latest numbers from the American Petroleum Institute show a decline of 6.8 million barrels in U.S. Crude stocks during the week ended May 19.

In addition, the Energy Information Administration (EIA) released its weekly Crude Oil Inventories report, which measures the weekly change in the number of barrels of commercial crude oil held by U.S. firms. Compared to last week, inventories fell by 12.456 million barrels. For reference, economists were expecting a decrease of 920,000 barrels week-over-week. This means that demand was much stronger than anticipated.

Meanwhile, natural gas also gained 3.32% to close at $2.398 per MMBtu and continues to trade firmly above the $2 mark.

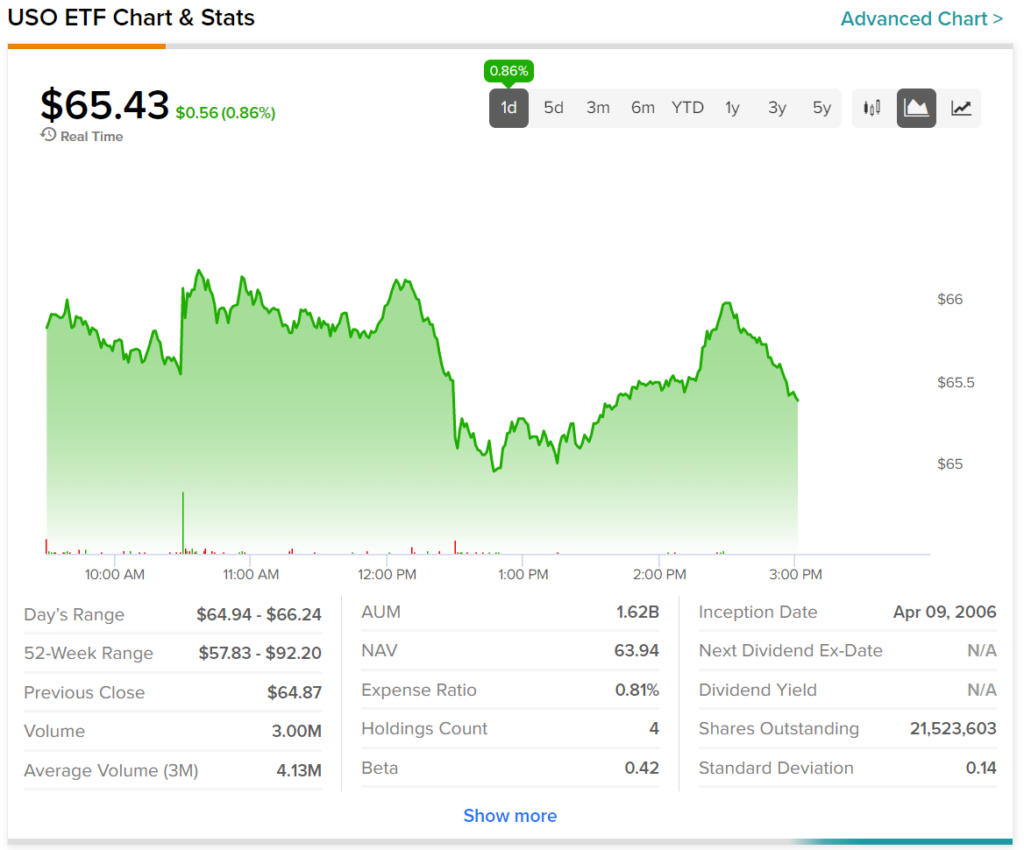

After yesterday’s 1.5% rise, the United States Oil Fund ETF (USO) is also up a further 0.86% to $65.43 at the time of writing. Here is a list of energy stocks that can be influenced by the latest developments in the energy markets.

Read full Disclosure