WTI Crude oil finished 0.18% lower at $85.46 per barrel after last week’s rout, as global economic worries continue to dampen sentiment.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Energy producers in the U.S. are not expected to ramp up production while OPEC’s supply cut begins to kick in. Moreover, rising costs could possibly mean a cutback in rigs in the U.S.

In the meantime, U.S. natural fell 7.04% to $5.999 today, as it continued its downward march.

Here are some stocks that could be affected by this news:

- Energy Select Sector SPDR Fund (XLE)

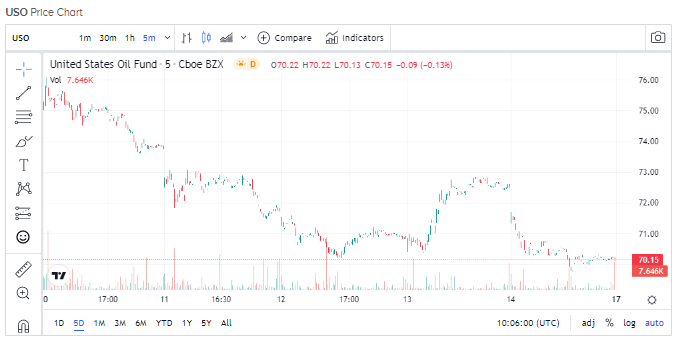

- United States Oil Fund LP (USO)

- ProShares Ultra Bloomberg Crude Oil (UCO)

- Exxon Mobil (XOM)

- Chevron (CVX)

- Occidental Petroleum (OXY)

- United States Natural Gas Fund LP (UNG)

- Cheniere Energy (LNG)

Read full Disclosure