Shares of ODDITY (NASDAQ:ODD), an Israel-based consumer tech platform focusing on the beauty and wellness market, closed 35% higher on its stock market debut yesterday. However, it lagged Mediterranean restaurant chain Cava (NYSE:CAVA) in IPO-day price appreciation, as CAVA stock surged over 99% after being listed.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Nonetheless, the strong performances from ODD and CAVA indicate investors’ growing risk appetite despite macro uncertainty. Notably, 2022 wasn’t a great year for IPOs, as economic weakness turned investors risk-averse.

What is ODDITY Tech?

ODDITY is a consumer tech platform that builds digital-first brands in the global beauty and wellness industry. It leverages its proprietary technology, AI (artificial intelligence), computer vision, molecular discovery, and data science-based online platforms to develop beauty products. The company currently has two digital, direct-to-consumer beauty brands, IL MAKIAGE and SpoiledChild.

Impressively, ODDITY is profitable, which is positive and supports the bull case. The company’s revenues are growing rapidly, and it achieved profitability quickly, with a double-digit adjusted EBITDA margin. The company delivered $324.5 million in revenues in 2022.

As for the three months ended June 30, 2023, ODDITY expects to deliver revenue in the range of $134.5 million and $144.5 million compared to $97.7 million in the prior-year quarter. Moreover, it projects net income in the range of $20.9 million and $24.9 million compared to $16.6 million in the prior-year period.

Whether ODDITY’s rapid growth could continue to drive its stock higher remains a wait-and-see story. Meanwhile, CAVA stock continues to head north since its IPO. Therefore, let’s check whether it has more upside left.

CAVA Stock Exceeded Analysts’ Price Target

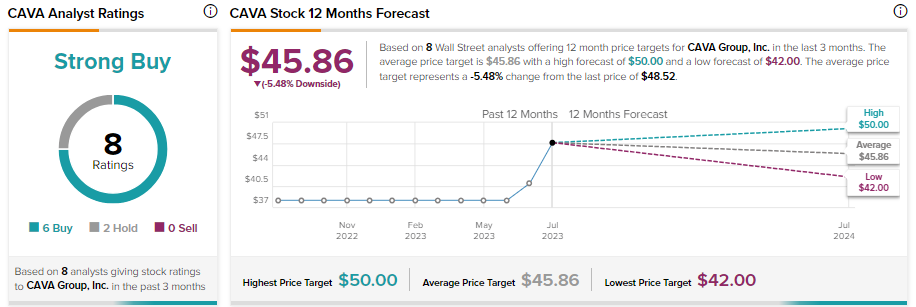

Wall Street is bullish on CAVA stock. It has received six Buy and two Hold recommendations for a Strong Buy consensus rating. However, given the rally in its share price, CAVA has exceeded analysts’ price target of $45.86, which implies downside potential of 5.48% from the current levels.