Occidental Petroleum (NYSE:OXY) reported lower-than-expected results for the fourth quarter of 2022. Nevertheless, the quarterly performance reflects year-over-year growth in revenue and earnings on higher sales volumes and prices. OXY shares trended lower in Monday’s after-hours trading even as the company announced a dividend hike and a new buyback program.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Occidental Petroleum engages in the exploration and production of oil and natural gas, primarily in the United States, the Middle East, and North Africa.

Q4 Results

The company posted adjusted earnings of $1.61 per share, lower than the Street’s estimate of $1.81 per share. The reported figure compares favorably with EPS of $1.48 in the prior-year quarter.

Meanwhile, Occidental posted Q4 revenues of $8.22 billion, which nearly doubled from $4.16 billion in the year-ago quarter but missed the Street’s estimate of $8.38 billion. The top line benefited from significantly higher sales in all segments, including Oil and Gas, Chemical, and Midstream.

During the quarter, the company disclosed selling oil for an average of $83.64/bbl, up 11% year-over-year.

Capital Deployment Activities

Occidental announced a 38% hike in its quarterly dividend to $0.18 per share. The same will be payable on April 17, 2023, to shareholders of record on March 10, 2023.

Also, the company’s board has approved a share buyback program of up to $3 billion. The new program was authorized after the company completed a $3 billion share buyback plan with the repurchase of shares worth $562 million in Q4 2022.

Occidental President and CEO Vicki Hollub said, “Our operational success drove the financial achievements that enabled us to complete our $3.0 billion share repurchase program and deliver substantial balance sheet improvements.”

Is OXY a Buy or Sell?

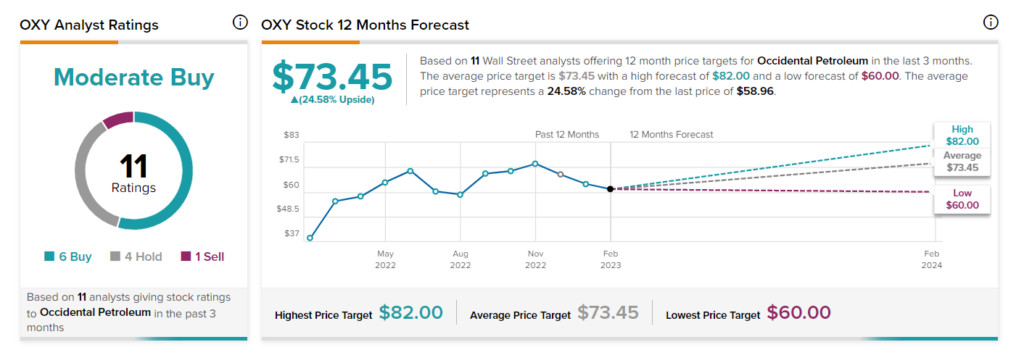

It is worth mentioning that Occidental remained Warren Buffett’s favorite oil and gas pick for 2022. Overall, Wall Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on six Buys, four Holds, and one Sell. The average price target of $73.45 implies 24.6% upside potential from current levels.