Oats-based alternative dairy products provider Oatly Group (NASDAQ:OTLY) has delivered a better-than-anticipated first-quarter performance on the revenue front.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Revenue rose 17.7% year-over-year to $195.65 million, outperforming expectations by $7.4 million. Net loss per share at $0.13 too landed in line with estimates. Impressively, the company witnessed sales growth across EMEA, the Americas as well as Asia region during this period. This momentum was boosted by volume gains as well as price increases.

Looking ahead, full-year revenue growth is anticipated between 23% and 28%. Additionally, gross margin is expected to improve further and is expected to reach high-20%s by the end of the year.

In another development, Oatly’s Global president Jean-Christophe Flatin is taking over the mantle as the company’s CEO from June 1. The company’s current CEO, Toni Petersson, will assume the role of Co-Chairman of its Board.

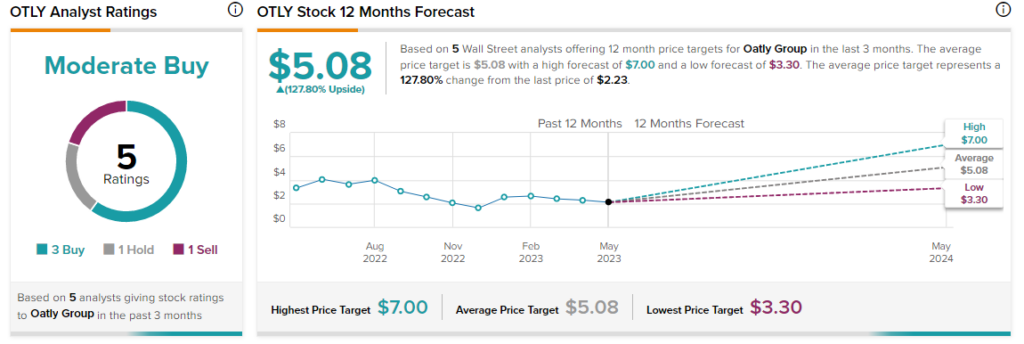

Overall, the Street has a $5.08 consensus price target on Oatly pointing to a massive 127.8% potential upside in the stock.

Read full Disclosure