After chip giant Nvidia’s (NASDAQ: NVDA) robust second-quarter performance left investors and analysts impressed, Philip Securities analyst Paul Chew upgraded the stock. The analyst upgraded the semiconductor company to a ‘Buy’ from a ‘Hold’ and significantly raised the price target to $645 from $440. The analyst’s current price target implies an upside potential of 42.1% from current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Chew attributed Nvidia’s commanding position to its “market monopoly” in Graphics Processing Units (GPUs) and noted the company’s performance as a “blowout.”

The analyst noted that the company’s Q2 results showcased a remarkable doubling of revenue, with data center sales nearly tripling year-over-year. The return to growth in the gaming sector, combined with strong data center performance, propelled the company’s success. The analyst highlighted Nvidia’s collaborative efforts with suppliers to enhance capacity, signaling a promising fiscal year ahead.

Chew added that Nvidia’s partnership with global foundry Taiwan Semiconductor (TSM) for chip production further solidifies its technological prowess. He emphasized the firm’s strategic shift toward accelerated computing and generative AI technology, predicting sustained demand growth for the Data Center business as the industry continues its transformative journey.

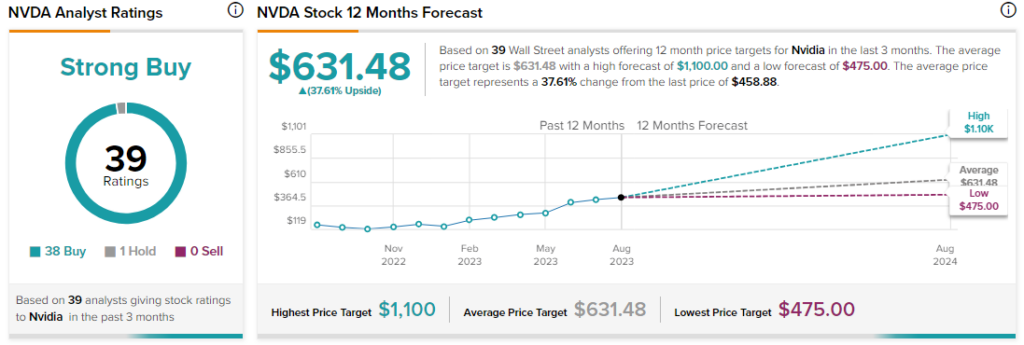

Analysts remain bullish about NVDA stock, with a Strong Buy consensus rating based on 38 Buys and one Hold.