The rise of artificial intelligence (AI) has fueled huge demand for advanced computing hardware, and two companies stand at the center of this boom — Nvidia (NVDA) and Super Micro Computer (SMCI). Nvidia dominates the AI chip market with its powerful GPUs, while Super Micro builds the high-performance servers that power those chips. Both companies have benefited from the AI infrastructure boom, with their stocks climbing sharply over the past year. Using TipRanks’ Stock Comparison Tool, we take a closer look at Nvidia and Super Micro to see which AI hardware stock analysts believe could lead the next rally.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wall Street Favors Nvidia’s Lead in AI Hardware

Nvidia remains the leading name in AI computing. The stock has gained about 36% year-to-date and 33% over the past year, driven by strong demand for its advanced GPUs, the growing adoption of its CUDA software as the global AI standard, and consistent business execution. To strengthen its hold on AI infrastructure, Nvidia recently expanded its collaboration with OpenAI through a $100 billion investment aimed at boosting AI development. The deal reinforces Nvidia’s close ties with OpenAI, ensuring continued demand for its GPUs.

Following the deal, several analysts remain optimistic about Nvidia’s outlook. Cantor Fitzgerald’s C.J. Muse, a top-rated analyst, reiterated Nvidia as his “top pick”, raising his price target to $300 from $240 while keeping an Overweight rating. Muse said the company is still “early in a multi-trillion-dollar AI infrastructure buildout” and believes Nvidia could maintain control of at least 75% of the AI accelerator market, with growth visibility extending well into the next decade.

Similarly, Barclays analyst Thomas O’Malley kept his Buy rating and raised his price target from $170 to $200, seeing about 9% upside. O’Malley called Nvidia’s deal with OpenAI a “compute bonanza,” pointing to huge growth potential in AI workloads.

Super Micro Strengthens Its Role in the AI Hardware Market

SMCI has become one of the biggest winners from the AI boom, driven by strong demand for its servers that power and train AI models. The stock is up about 73% year-to-date and 11.5% over the past year. The company keeps rolling out new servers built for faster computing and lower energy use, supplying major data center and cloud clients. Its growing role in both data center and edge AI markets has made it a key supplier in global AI infrastructure.

Recent product launches have also supported the stock. Last month, Super Micro introduced new AI systems at its INNOVATE! EMEA 2025 event, featuring servers powered by HGX B300 and GB300 NVL72 platforms. These updates strengthen its position in the AI hardware market and highlight its focus on efficiency and performance.

However, the company has also faced some challenges. Shares fell about 5% after Super Micro disclosed weaknesses in internal controls. Recently, Bernstein analyst Mark Newman maintained a Hold rating and a $46 price target, noting that while the company remains one of the purest AI server plays, recent earnings misses and accounting concerns raise caution. He added that although Super Micro has posted strong growth, its pace of expansion may be hard to sustain.

NVDA or SMCI: Which Stock Offers Higher Upside, According to Analysts?

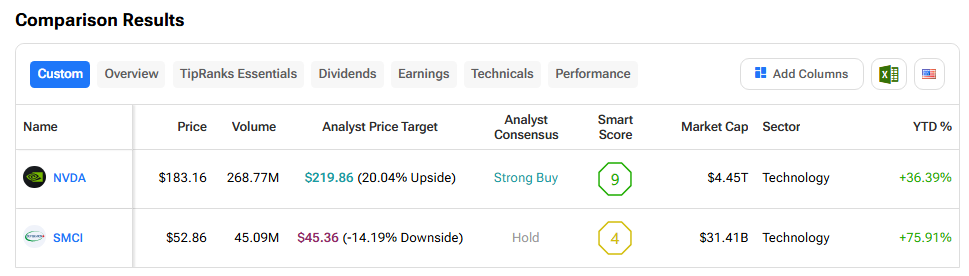

Using TipRanks’ Stock Comparison Tool, we compared Nvidia and SMCI to see which AI hardware stock analysts currently favor. Nvidia holds a Strong Buy consensus rating with a projected 20.04% upside, while Super Micro has a Hold rating and a potential 14.19% downside from current levels. Nvidia also carries a higher Smart Score of 9, compared to 4 for Super Micro, suggesting stronger analyst confidence and performance potential.

Bottom Line

Both Nvidia and Super Micro play critical roles in powering the AI revolution, but analysts see more upside in Nvidia, backed by its strong ecosystem and clear lead in AI hardware. Meanwhile, Super Micro remains a key player in AI servers and has benefited from rapid demand growth, but accounting concerns and continuous earnings misses over the past three quarters have made analysts more cautious in the near term.