Elon Musk’s SpaceX moved $257 million in Bitcoin on Tuesday in what analysts say could be part of a broader repositioning of its crypto reserves. Blockchain data show that SpaceX-linked wallet “1MDyM” transferred roughly $130 million in Bitcoin to address “bc1qj”, while another wallet “1AXeF” sent $127 million to “bc1qq.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to blockchain intelligence platform Nansen, neither of the receiving wallets has sold or moved the Bitcoin since the transfers occurred. That leaves open questions about whether the transactions represent internal restructuring or a potential sale.

The moves follow SpaceX’s July transaction, when it shifted $153 million worth of Bitcoin, its first fund movement since 2022. SpaceX hasn’t commented publicly on its motives for either transfer.

Musk’s Bitcoin History Complicates the Picture

Elon Musk’s relationship with Bitcoin has long been both influential and unpredictable. SpaceX first disclosed Bitcoin holdings in July 2021, around the same time Tesla (TSLA) revealed its own $1.5 billion BTC purchase. Musk called Bitcoin a “sound monetary system” but later tempered his enthusiasm over environmental concerns tied to mining energy use.

In May 2021, Tesla suspended Bitcoin payments for its vehicles, citing those environmental issues—a move that sent Bitcoin’s price down nearly 6% within an hour. While Tesla has not sold most of its Bitcoin since then, it also hasn’t reinstated crypto payments, despite Musk’s earlier suggestion that it would once renewable energy usage improved.

Today, this metric has indeed changed. Data from Daniel Batten and Willy Woo show over 55% of Bitcoin mining energy now comes from sustainable sources, a record high that has revived optimism among industry advocates. Yet Musk’s own companies remain quiet on whether that milestone will change their policies.

SpaceX Faces Pressure as Competition Escalates

The timing of SpaceX’s Bitcoin movements has raised concerns, coming as the company faces mounting financial and political pressure on other fronts.

On Monday, NASA’s acting chief, Sean Duffy, announced that the agency would open its lunar lander contract to new competitors, citing delays in SpaceX’s Starship development. “We are competing with China, so we need the best company to let us land on the moon as soon as possible. SpaceX has won a contract to build HLS, but the progress is slow,” Duffy told CNBC.

This contract, worth $4.4 billion, initially positioned SpaceX as NASA’s lead lunar partner, with a 2027 moon-landing deadline. But setbacks in the Starship program have invited challengers like Blue Origin and Lockheed Martin, both expected to bid aggressively for a share of NASA’s next phase of lunar exploration.

The financial pressure of delivering on such massive projects, coupled with SpaceX’s continued private funding needs, has led to speculation that the Bitcoin transfers could represent liquidity management ahead of new capital expenditures.

Speculation Grows Over SpaceX’s Bitcoin Intentions

Analysts remain divided on what the latest transactions mean. Some argue SpaceX may simply be reorganizing its cold wallets, a common practice for security or accounting reasons. Others see potential signs of profit-taking or collateral shifts as the company juggles operational spending and competition from both traditional aerospace firms and emerging private players.

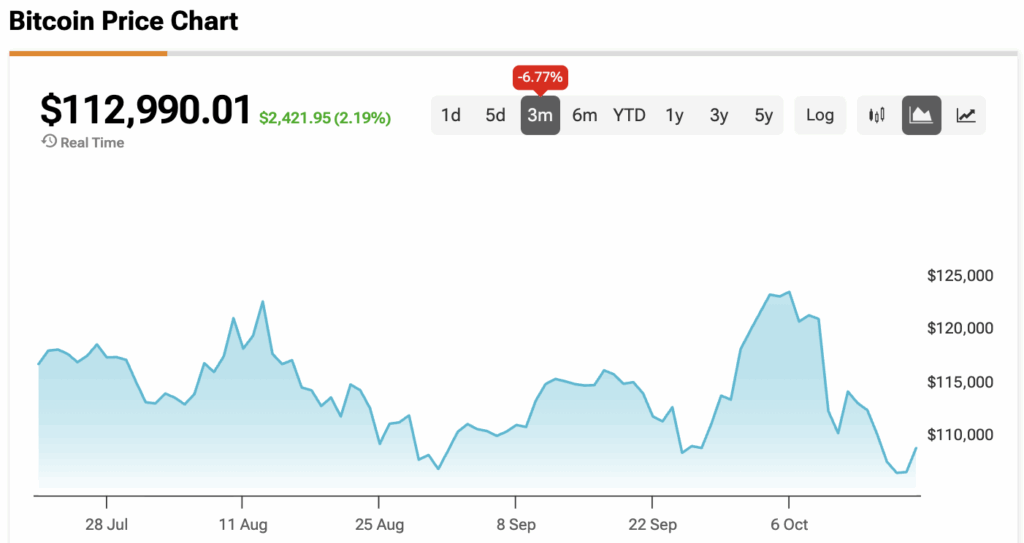

So far, the on-chain data doesn’t confirm a sale. The receiving wallets remain idle, and Bitcoin’s price has held just below $113,000, showing little immediate market reaction.